Building an emergency fund is a crucial step towards financial security, yet many find themselves starting from zero. This comprehensive guide outlines practical strategies to build an emergency fund from scratch, even on a tight budget. Learn how to assess your financial situation, set realistic savings goals, and automate your savings to create a financial safety net for unexpected expenses. Starting an emergency fund, even with small contributions, can provide peace of mind and protect you from financial hardship. Whether you’re dealing with debt, living paycheck to paycheck, or simply want to bolster your financial resilience, this guide will empower you to start building your emergency fund today.

Having an emergency fund provides a buffer against unforeseen circumstances like job loss, medical emergencies, or unexpected car repairs. It allows you to cover essential expenses without resorting to high-interest debt or depleting your long-term savings. This guide will explore various methods for saving effectively, including budgeting tips, identifying areas to cut expenses, and exploring potential income streams to accelerate your emergency fund growth. From zero to a substantial safety net, you can achieve financial stability by following the steps outlined in this article. Take control of your finances and learn how to start an emergency fund from zero, regardless of your current financial situation.

Why Everyone Needs an Emergency Fund

An emergency fund is a crucial financial safety net designed to cover unexpected expenses. Life is full of surprises, not all of them pleasant. Job loss, unexpected medical bills, car repairs, or home appliance malfunctions can all create significant financial strain. Having an emergency fund provides a buffer against these unforeseen events, preventing the need to rely on high-interest credit cards or loans which can exacerbate financial difficulties.

Maintaining an emergency fund offers peace of mind and financial stability. Knowing you have resources readily available to handle emergencies reduces stress and allows for more informed decision-making. Instead of panicking when faced with an unexpected expense, you can address the situation calmly and rationally, knowing you have the financial capacity to manage it. This stability is particularly important during times of economic uncertainty.

Building an emergency fund takes discipline and planning, but the benefits are well worth the effort. Financial experts generally recommend saving three to six months’ worth of living expenses. Start small and consistently contribute to your fund. Even small amounts add up over time. Consider setting up automatic transfers to a dedicated savings account to make saving effortless.

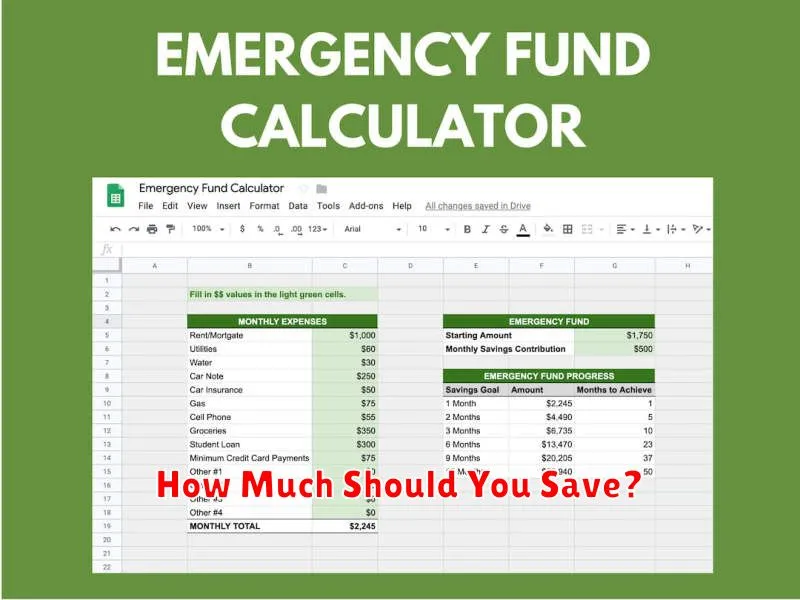

How Much Should You Save?

Determining the right amount to save depends on your individual financial circumstances and goals. A commonly cited guideline is the 50/30/20 rule, which suggests allocating 50% of your after-tax income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. However, this is just a starting point. Factors such as your age, income, existing debt, and future plans (like buying a house or retiring) will influence your ideal savings rate.

Prioritize building an emergency fund covering 3-6 months of essential expenses. This safety net protects you from unexpected financial hardships like job loss or medical emergencies. Once your emergency fund is established, focus on other savings goals, such as retirement, a down payment on a house, or investing. Consider automating your savings by setting up regular transfers from your checking account to your savings account. This helps ensure consistent progress towards your goals.

For retirement, aim to save at least 15% of your pre-tax income, including any employer match. If you start saving later in your career, you may need to save a higher percentage. Explore different retirement savings vehicles, such as 401(k)s and IRAs, and take advantage of any employer-sponsored retirement plans.

Setting Realistic Monthly Goals

Setting realistic monthly goals is crucial for consistent progress and maintaining motivation. Start by identifying two to three key areas you want to focus on. Avoid overwhelming yourself with too many objectives. Within each area, define specific, measurable, achievable, relevant, and time-bound (SMART) goals. For example, instead of “improve fitness,” aim for “attend three yoga classes per week” or “walk for 30 minutes four times a week.” This clarity provides direction and allows for accurate progress tracking.

Break down your monthly goals into smaller, weekly or even daily tasks. This approach makes the overall objective less daunting and creates opportunities for regular wins, boosting your sense of accomplishment. Consider potential obstacles and develop strategies to overcome them. For instance, if your goal is to reduce spending, anticipate situations that might trigger unnecessary purchases and plan alternative actions. Flexibility is also key. Life rarely goes exactly as planned, so be prepared to adjust your goals as needed. If you find yourself consistently falling short, re-evaluate the goal’s feasibility and modify it to better align with your current circumstances.

Regularly review your progress and celebrate your successes. Tracking your achievements, no matter how small, reinforces positive behavior and keeps you motivated. At the end of the month, reflect on what worked well and identify areas for improvement. This process of self-assessment provides valuable insights for setting future goals and continuing your growth trajectory.

Where to Keep Your Emergency Fund

An emergency fund serves as a financial safety net, providing a cushion for unexpected expenses like medical bills, job loss, or car repairs. Therefore, accessibility and preservation of capital are paramount when deciding where to store these funds. It’s crucial to avoid investments that fluctuate in value, as market downturns could deplete your resources when you need them most.

High-yield savings accounts and money market accounts are generally considered ideal locations for emergency funds. These accounts offer FDIC insurance (up to $250,000 per depositor, per insured bank, for each account ownership category), protecting your money from bank failure. Additionally, they typically offer modest interest rates, allowing your savings to grow slowly while remaining readily accessible.

While certificates of deposit (CDs) offer higher interest rates, their fixed terms may limit your access to funds. Consider CDs only for a portion of your emergency fund if you have a longer time horizon for some of those savings. Avoid investing emergency funds in the stock market or other volatile investments, as their value can fluctuate significantly, potentially leaving you short of funds during an emergency.

Automating Contributions

Automating contributions, especially in software development, can significantly boost efficiency and consistency. Automation can streamline tasks such as code formatting, testing, and deployment. By defining clear rules and processes, automated systems ensure that contributions adhere to established standards, reducing the burden on human reviewers and minimizing errors. This frees up developers to focus on more complex and creative tasks.

Several tools facilitate contribution automation. Continuous Integration/Continuous Deployment (CI/CD) pipelines automate the build, test, and deployment phases of software development. Automated code formatters ensure consistent styling. Automated testing frameworks help identify bugs early in the development cycle. These tools, when implemented effectively, create a smoother and more reliable contribution workflow.

While automation offers numerous benefits, it’s crucial to implement it thoughtfully. Over-reliance on automation can lead to a decrease in developer understanding of the underlying processes. Flexibility must be maintained to accommodate unique situations and edge cases that automated systems may not handle gracefully. Regular review and adjustment of automated processes are essential for maintaining their effectiveness and preventing them from becoming bottlenecks.

Cutting Non-Essentials to Save Faster

Saving money effectively often requires identifying and eliminating non-essential expenses. These are costs that don’t significantly impact your quality of life, yet drain your finances over time. Common examples include frequent dining out, subscription services you rarely use, impulse purchases, and expensive hobbies. By carefully evaluating your spending habits and cutting back on these extras, you can free up significant cash flow towards your savings goals. This doesn’t necessarily mean drastically changing your lifestyle, but rather making conscious choices about where your money goes.

One helpful strategy is to create a budget. This allows you to track your income and expenses, highlighting areas where you might be overspending. Consider using budgeting apps or spreadsheets to simplify the process. Categorize your expenses into needs versus wants. Needs are essential for daily living, such as rent and groceries. Wants are things that improve your life but aren’t strictly necessary. Focus your cuts on the wants category.

Small changes can make a big difference. Brewing coffee at home instead of buying it daily, canceling unused subscriptions, and bringing your lunch to work are just a few examples. These seemingly minor adjustments can add up to substantial savings over time, accelerating your progress towards your financial goals. Remember to prioritize what truly matters to you and focus your spending accordingly.

When to Use Emergency Funds

Emergency funds are designed for unexpected and necessary expenses. These are situations that impact your financial stability and require immediate attention. Think sudden job loss, urgent medical bills (including unexpected vet bills), essential home or car repairs (like a broken furnace in winter or a necessary transmission fix), or other unforeseen events that create a significant, unavoidable cost. An emergency fund is not intended for discretionary spending, vacations, or non-essential purchases.

Before dipping into your emergency fund, carefully consider if the situation truly qualifies as an emergency. Ask yourself: Is this expense unavoidable? Is it urgent, requiring immediate attention? Will this significantly impact my financial well-being if I don’t address it now? If you answer “yes” to these questions, using your emergency fund is likely justified. If the expense can be delayed, planned for, or covered through other means, explore those options first.

Once you’ve used your emergency fund, make it a priority to replenish it as quickly as possible. Create a repayment plan and stick to it to ensure you’re prepared for the next unexpected event. Having a robust emergency fund provides peace of mind and financial security.

Rebuilding After a Withdrawal

Withdrawal, whether from a substance, medication, or a relationship, can be a challenging experience. It often involves a period of adjustment as the body and mind recalibrate. Understanding this process and prioritizing self-care are crucial for rebuilding and moving forward. Focusing on healthy habits like proper nutrition, exercise, and adequate sleep helps to restore physical well-being. Equally important is addressing the emotional and psychological impact through therapy, support groups, or mindfulness practices. These strategies provide a foundation for healing and personal growth.

Developing healthy coping mechanisms is essential for navigating triggers and cravings that may arise during the rebuilding phase. This might involve learning stress management techniques, engaging in creative activities, or spending time in nature. Building a strong support system is also vital. Connecting with trusted friends, family members, or mentors can provide encouragement and accountability. Seeking professional guidance can also be beneficial, offering personalized strategies and a safe space to process emotions.

Recovery is an ongoing journey, not a destination. It’s important to be patient with yourself and celebrate small victories along the way. Remember that setbacks are a normal part of the process, and they don’t define your progress. Focus on building a future aligned with your values and goals. This might involve exploring new interests, pursuing educational opportunities, or re-engaging in activities that bring joy and fulfillment. By embracing self-compassion and perseverance, it is possible to rebuild a fulfilling and meaningful life after withdrawal.

Tracking Progress Over Time

Tracking progress is essential for achieving any goal, whether personal or professional. It allows you to measure how far you’ve come, identify areas for improvement, and stay motivated along the way. By regularly monitoring your progress, you can adjust your strategies and ensure you’re on the right path to success. This can involve setting milestones, using tracking tools, or simply reflecting on your accomplishments.

There are various methods for effectively tracking progress. Some common techniques include using spreadsheets, journaling, dedicated progress tracking apps, or even visual representations like charts and graphs. The key is to choose a method that suits your needs and preferences. Consistency is crucial, as sporadic tracking won’t provide a clear picture of your overall advancement.

The benefits of tracking progress extend beyond simply measuring success. It fosters a sense of accountability, helps identify potential roadblocks early on, and provides valuable data for future planning. Regularly reviewing your progress reinforces positive momentum and helps maintain focus on your ultimate objective.