Creating a monthly budget is the cornerstone of effective personal finance. A well-structured budget empowers you to take control of […]

financial.teknoterkini.id

Best High-Interest Checking Accounts in 2025

Finding the best high-interest checking accounts is crucial for maximizing your earnings in 2025. With interest rates fluctuating, it’s more […]

How to Build Credit Without a Credit Card

Building credit is essential for financial health, enabling access to loans, mortgages, and even better insurance rates. Many assume a […]

Best Ways to Save for a Down Payment on a House

Saving for a down payment on a house can feel like a daunting task, but it’s an achievable goal with […]

Should You Pay Off Debt or Invest First?

Deciding whether to prioritize paying off debt or investing is a crucial financial dilemma many people face. This article explores […]

Using a Financial Advisor vs DIY Planning: What’s Better?

Deciding how to manage your finances is a crucial step towards achieving your financial goals. Are you considering using a […]

How to Avoid Lifestyle Inflation as Your Income Grows

Lifestyle inflation is a common phenomenon where your spending increases in tandem with your rising income. It can be a […]

Top Budgeting Apps to Manage Your Money in 2025

Managing your finances effectively is crucial in today’s dynamic economic landscape. In 2025, leveraging technology through budgeting apps can significantly […]

What to Do With a Tax Refund: 10 Smart Ideas

A tax refund can feel like a financial windfall, but spending it wisely is crucial. This article explores ten smart […]

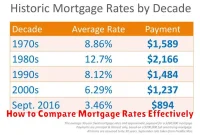

How to Compare Mortgage Rates Effectively

Comparing mortgage rates is a crucial step in the home-buying process. Securing the lowest possible interest rate can save you […]

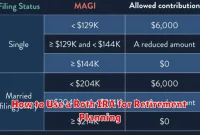

How to Use a Roth IRA for Retirement Planning

Planning for a secure retirement requires careful consideration of various investment strategies. A Roth IRA (Individual Retirement Account) stands out […]

How to Plan for Early Retirement in Your 50s

Planning for early retirement in your 50s requires a proactive and strategic approach. Many individuals dream of retiring early, but […]

Best Credit Cards for Cashback and Rewards in 2025

Choosing the best credit card for your needs can be a daunting task, especially with the myriad of options available. […]

Retirement Planning Mistakes to Avoid in Your 40s

Planning for retirement is a continuous process, and your 40s represent a crucial period for solidifying your financial future. While […]

How to Use Balance Transfer Cards to Reduce Debt

Are you struggling with high-interest credit card debt? A balance transfer card can be a powerful tool to help you […]

- 1

- 2