Saving for a down payment on a house can feel like a daunting task, but it’s an achievable goal with the right strategies. This article explores the best ways to save for that crucial down payment, offering practical advice and actionable steps to help you achieve your dream of homeownership. Whether you’re a first-time homebuyer or looking to upgrade, understanding the nuances of saving for a house is paramount. From budgeting and cutting expenses to exploring various savings accounts and investment options, we’ll cover key strategies to help you reach your down payment goals efficiently.

Navigating the complex world of real estate requires careful financial planning. One of the most significant hurdles is often the initial down payment. We’ll delve into the best ways to save money, offering insights into how much you should aim to save for your down payment, along with effective saving strategies tailored to different financial situations. Learn how to accelerate your savings journey, overcome common challenges, and make your dream of owning a home a reality by understanding the best ways to save for a down payment.

Setting a Down Payment Goal

Setting a down payment goal is a crucial first step in the home-buying process. The amount you put down significantly impacts your mortgage terms, including the loan amount, interest rate, and monthly payments. A larger down payment generally translates to a lower loan amount, reducing the overall cost of your home over time. It can also help you secure a more favorable interest rate and potentially eliminate the need for private mortgage insurance (PMI) if you reach the 20% threshold. Carefully consider your financial situation and long-term goals when determining your target down payment amount.

While 20% is often cited as the standard down payment, it’s not always a requirement. There are various loan programs available that allow for significantly lower down payments, some as low as 3% or even 0%. However, opting for a smaller down payment usually means higher monthly payments and the added expense of PMI. Evaluate the different loan options and weigh the pros and cons of each to determine what aligns best with your budget and financial circumstances.

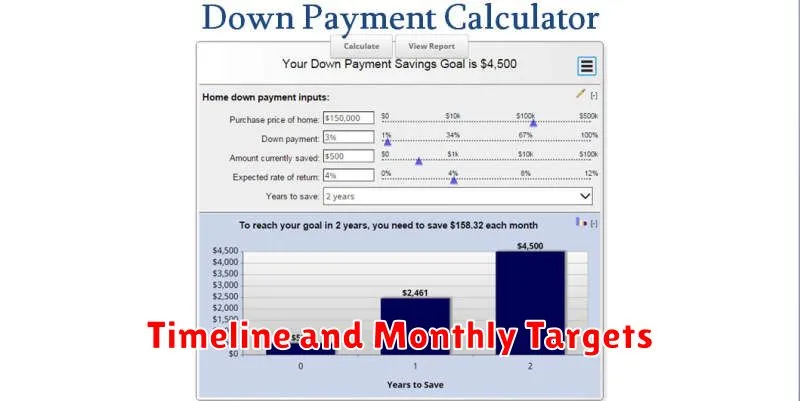

To effectively reach your down payment goal, create a realistic savings plan. Determine a monthly savings target and explore strategies to accelerate your progress. This might include reducing discretionary spending, increasing your income through a side hustle, or reallocating funds from other savings goals. Consistently contributing to your down payment fund will help you achieve your homeownership dreams sooner.

Timeline and Monthly Targets

This project will span six months, beginning on October 1, 2024 and concluding on March 31, 2025. Key milestones include the completion of the initial design phase by November 15, 2024, the commencement of development on December 1, 2024, and the beta launch on February 1, 2025.

Monthly targets are designed to ensure steady progress. In October, we will focus on requirements gathering and design. November will be dedicated to finalizing the design and initiating the development environment setup. December marks the beginning of core development. January will see continued development and initial testing procedures. February will focus on beta testing and feedback integration. Finally, March will be dedicated to final testing, deployment, and launch.

Success will be measured by achieving these milestones on time and within budget, along with delivering a product that meets the pre-defined quality standards and user expectations. Effective communication and collaboration among team members are crucial for successful execution.

High-Interest Savings Accounts

A high-interest savings account is a type of savings account that offers a higher-than-average annual percentage yield (APY). This means you earn more interest on your deposited funds compared to a traditional savings account. These accounts are offered by various financial institutions, including online banks and credit unions, and are a valuable tool for growing your savings faster.

Choosing the right high-interest savings account requires comparing APYs, fees, and features across institutions. Some factors to consider include: minimum balance requirements, monthly maintenance fees, ATM access, and ease of online banking. Interest rates are variable and can fluctuate based on market conditions, so it’s important to monitor your account and compare it with competing offers periodically. By selecting an account with competitive terms and consistently contributing to it, you can maximize your savings potential.

The benefits of a high-interest savings account include the potential for greater returns and the flexibility to access your funds. While the interest earned is taxable, the higher APY can significantly contribute to achieving your financial goals, whether it’s saving for a down payment, building an emergency fund, or planning for retirement. Keeping your money in a high-interest savings account also preserves its liquidity, allowing you to withdraw funds when needed without penalty, unlike some other investment vehicles.

Certificates of Deposit (CDs)

A Certificate of Deposit (CD) is a savings account that holds a fixed amount of money for a fixed period of time, earning a fixed interest rate. CDs offer a higher interest rate than a regular savings account, but with the trade-off of limited access to your funds. The maturity date is the date when the CD term ends, at which point you can withdraw your initial deposit plus the accrued interest. Early withdrawal typically incurs a penalty, which might forfeit a portion of the earned interest.

CDs are generally considered a low-risk investment, especially when held at FDIC-insured banks. The FDIC insures deposits up to $250,000 per depositor, per insured bank, for each account ownership category. This means your principal and interest are protected up to that amount in case of bank failure. CDs offer a predictable return, making them suitable for conservative investors or those looking to preserve capital.

Several factors should be considered when choosing a CD, including the term length (ranging from a few months to several years), the interest rate offered, and any applicable fees or penalties. It’s essential to compare offers from different financial institutions to find the most favorable terms. You should also consider your financial goals and time horizon before investing in a CD.

Using a Dedicated Budget Plan

A dedicated budget plan is a powerful tool for managing your finances effectively. It involves allocating specific amounts of money to different spending categories, allowing you to track where your money is going and ensure you’re meeting your financial goals. Creating and sticking to a budget can help you reduce unnecessary spending, save for the future, and gain a stronger sense of financial control.

Developing a budget involves several key steps. First, calculate your income and track your expenses to understand your current spending habits. Then, set realistic financial goals, whether it’s saving for a down payment, paying off debt, or building an emergency fund. Next, allocate funds to essential categories like housing, food, and transportation, as well as discretionary spending like entertainment and dining out. Finally, monitor your progress regularly and adjust your budget as needed to stay on track.

There are numerous benefits to using a dedicated budget plan. It allows you to identify areas where you can save money, prioritize your spending based on your goals, and avoid overspending. A budget also provides a clear picture of your financial health, enabling you to make informed decisions about your money and achieve financial stability.

Cutting Costs and Increasing Income

Cutting costs and increasing income are two fundamental ways to improve your financial well-being. Reducing expenses can involve evaluating your current spending habits and identifying areas where you can save. This might include dining out less frequently, finding more affordable entertainment options, or negotiating lower rates for services like insurance or cable. Carefully tracking your expenses for a month can provide valuable insight into your spending patterns and highlight potential areas for improvement.

Increasing income can take various forms, depending on your circumstances. Exploring opportunities for a raise or promotion at your current job is a good starting point. Developing new skills through online courses or workshops can increase your earning potential. You could also consider supplementing your income with a part-time job, freelance work, or by monetizing a hobby. Even small increases in income can make a significant difference over time.

By actively working to both reduce expenses and increase income, you can create a more stable financial foundation and achieve your financial goals more effectively. Whether it’s saving for a down payment on a house, paying off debt, or investing for the future, taking control of your finances empowers you to build a stronger financial future.

Saving Windfalls and Bonuses

Receiving a windfall or bonus is an exciting financial opportunity. Instead of immediately spending it, consider making the most of this extra income by prioritizing saving and investing. Saving a portion of the money can help build an emergency fund, pay down high-interest debt, or contribute to long-term goals like retirement or a down payment on a house. Investing a portion can help grow your wealth over time. Before making any decisions, carefully assess your current financial situation and identify your short-term and long-term financial goals.

Creating a plan for your windfall or bonus can maximize its impact. Start by determining a percentage to allocate towards different objectives. For example, you might decide to allocate 50% to savings, 30% to debt repayment, and 20% to investments. Prioritizing high-interest debt, such as credit card debt, can save you money in the long run. Contributing to a retirement account can provide tax advantages and help secure your future. Building a solid emergency fund can protect you from unexpected expenses and financial hardship.

Consulting with a financial advisor can be beneficial, especially for larger windfalls or bonuses. A financial advisor can provide personalized guidance based on your individual circumstances and goals. They can help you develop a comprehensive financial plan and recommend suitable investment strategies. Remember, making informed decisions about your windfall or bonus can significantly improve your overall financial well-being.

Down Payment Assistance Programs

Down payment assistance programs (DPAs) can help make homeownership a reality by providing financial assistance to cover the down payment and closing costs associated with purchasing a home. These programs, often offered by state and local governments or non-profit organizations, aim to reduce the financial barriers to entry for first-time homebuyers and other eligible individuals. Eligibility requirements vary based on income limits, credit scores, and the specific program guidelines. Some programs are grants, while others are structured as low-interest or forgivable loans. It’s crucial to thoroughly research available DPAs in your area to find the best fit for your individual circumstances.

DPAs can come in various forms, including grants, zero-interest loans, deferred payment loans, and matched savings programs. Grants don’t require repayment, while loans may have specific terms and conditions. Some loans may be forgiven after a certain period if the homeowner remains in the property, effectively turning them into grants. Matched savings programs incentivize saving by matching a portion of the funds saved by the homebuyer. Understanding the terms and conditions of each DPA is essential, including any requirements regarding homebuyer education courses or specific property types.

Finding the right DPA for your situation requires research and careful consideration. Start by contacting your local housing authority or a HUD-approved housing counseling agency. They can provide guidance and information about available programs in your area. You can also search online for state and local DPA programs. Be sure to compare program requirements, benefits, and eligibility criteria before applying. Choosing the right DPA can significantly reduce the initial financial burden of homeownership and help you achieve your dream of owning a home.