Creating a monthly budget is the cornerstone of effective personal finance. A well-structured budget empowers you to take control of your finances, allocate your money wisely, and achieve your financial goals. This guide will provide you with practical steps to create a monthly budget that actually works, breaking down the process into manageable steps. Whether you’re struggling to make ends meet, aiming to save for a down payment, or simply looking to gain better control over your spending, learning how to budget effectively is a crucial skill.

Stop wondering where your money goes each month and start planning for a more secure financial future. This article outlines the key components of a successful monthly budget, including tracking your income and expenses, setting realistic financial goals, and identifying areas where you can save money. Learn how to create a budget that is not only effective but also sustainable, allowing you to manage your finances with confidence and work towards achieving your long-term financial aspirations.

The Psychology Behind Budgeting

Budgeting is often perceived as a restrictive financial practice, but its psychological impact goes far beyond mere number-crunching. It provides a sense of control over one’s finances, reducing stress and anxiety related to money. By clearly outlining income and expenses, individuals gain a better understanding of their spending habits and can identify areas where adjustments can be made. This awareness empowers individuals to make conscious financial decisions, leading to increased confidence and a greater sense of financial security. A well-defined budget also serves as a tangible roadmap towards achieving financial goals, whether it’s saving for a down payment, paying off debt, or investing for the future. This sense of purpose and direction can be highly motivating, contributing to a more positive overall financial outlook.

However, the psychology of budgeting also involves navigating potential challenges. One common hurdle is the emotional aspect of spending. Impulse purchases, driven by instant gratification, can derail even the most meticulously planned budgets. Overcoming this requires cultivating mindfulness and developing strategies to resist impulsive spending triggers. Another challenge lies in maintaining consistency. Budgeting requires ongoing effort and adjustments, which can be demanding. Building sustainable budgeting habits often involves finding a method that aligns with individual preferences and incorporating flexibility to accommodate unexpected expenses or changes in income. By acknowledging and addressing these psychological factors, individuals can effectively leverage budgeting as a tool for achieving long-term financial well-being.

Successfully integrating budgeting into one’s life requires a shift in mindset. It’s about viewing a budget not as a constraint, but as an instrument of empowerment. It enables informed decision-making, facilitates progress towards financial goals, and fosters a healthier relationship with money. By understanding the psychological factors at play, individuals can overcome potential obstacles and unlock the full potential of budgeting as a catalyst for financial success.

Setting Realistic Financial Goals

Setting realistic financial goals is crucial for achieving financial security and overall well-being. A realistic goal considers your current income, expenses, and existing debts. It’s important to distinguish between needs and wants. Prioritize essential expenses like housing, food, and transportation, then allocate remaining funds towards achieving your financial objectives. Start with small, attainable goals and gradually progress toward larger ones as your financial situation improves. This approach promotes a sense of accomplishment and motivates you to continue striving for financial success.

Examples of realistic financial goals might include: building an emergency fund, paying down high-interest debt, saving for a down payment on a house, or investing for retirement. Setting a timeline for each goal is essential for accountability and tracking progress. Break down larger goals into smaller milestones to make them less daunting and more manageable. Regularly review and adjust your goals as needed based on life changes, such as a salary increase or unexpected expenses. Flexibility is key to maintaining realistic expectations and staying on track.

Using budgeting tools and resources can greatly assist in setting and achieving realistic financial goals. These tools can help track spending, identify areas for potential savings, and project future financial outcomes. Seeking guidance from a financial advisor can also provide valuable insights and personalized strategies. Remember, setting realistic financial goals is a dynamic process that requires ongoing evaluation and adjustments. With careful planning and disciplined execution, you can achieve your financial aspirations and build a secure financial future.

Income vs Expense Tracking

Income and expense tracking are essential components of personal and business financial management. Income tracking involves monitoring all sources of revenue, including salaries, wages, investments, and business profits. This provides a clear picture of incoming funds. Conversely, expense tracking focuses on identifying and recording all expenditures, such as rent, utilities, groceries, transportation, and loan payments. Accurate tracking of both income and expenses is crucial for budgeting, financial planning, and identifying areas for potential savings.

By diligently tracking income and expenses, individuals and businesses can gain valuable insights into their financial health. Comparing income against expenses reveals whether there is a surplus (profit) or a deficit (loss). This information is fundamental for making informed financial decisions. Furthermore, detailed tracking allows for the identification of spending patterns and areas where expenses can be reduced or optimized. This can lead to improved financial stability and the achievement of financial goals.

Various methods exist for tracking income and expenses. Traditional methods include maintaining a physical ledger or using spreadsheets. However, numerous digital tools and software applications are available that automate the process and provide real-time financial analysis. These tools often offer features like budget creation, expense categorization, and the generation of reports that provide a comprehensive overview of financial performance.

Choosing the Right Budgeting Method

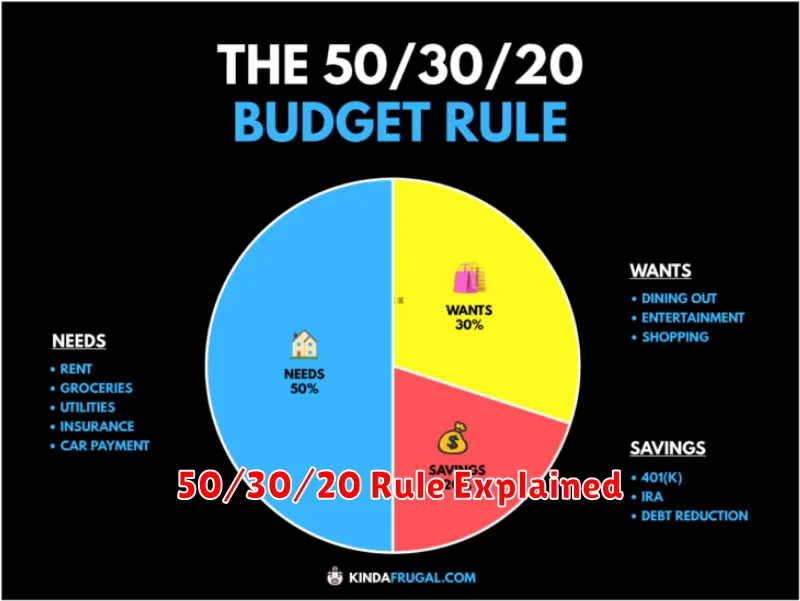

Effective budgeting is crucial for financial stability and achieving your financial goals. Several methods exist, each with its own advantages and disadvantages. Understanding your spending habits and financial priorities is key to selecting the best fit. Popular methods include the 50/30/20 budget, which allocates 50% of income to needs, 30% to wants, and 20% to savings and debt repayment; the envelope system, which involves allocating cash to specific spending categories; and zero-based budgeting, where every dollar is assigned a purpose, ensuring income minus expenses equals zero.

The 50/30/20 method provides a simple framework for balancing essential expenses, lifestyle choices, and financial security. The envelope system promotes mindful spending by limiting expenditures to available cash within each designated category. Zero-based budgeting offers granular control and ensures that all income is accounted for and allocated strategically. Choosing between these depends on individual preferences and spending patterns. Those seeking simplicity might prefer the 50/30/20 approach, while those prone to overspending could benefit from the envelope system’s tangible limitations.

Regardless of the method chosen, consistency and regular review are essential for budgeting success. Tracking expenses and making adjustments as needed will ensure your budget remains aligned with your financial objectives. Consider using budgeting apps or spreadsheets to streamline the process and gain valuable insights into your spending behavior. Ultimately, the most effective budgeting method is the one you can realistically maintain over the long term.

50/30/20 Rule Explained

The 50/30/20 rule is a simple budgeting method that can help you manage your money effectively. It allocates your after-tax income into three main categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This straightforward approach makes it easy to track your spending and ensure you’re prioritizing your financial goals.

Your needs are the essential expenses you must pay to live. This includes things like rent or mortgage payments, groceries, utilities, transportation, and health insurance. Wants are non-essential expenses that bring you enjoyment, such as dining out, entertainment, hobbies, and shopping. Finally, the savings and debt repayment category includes saving for emergencies, retirement, paying down debt like credit cards or student loans, and investing.

By following the 50/30/20 rule, you can create a balanced budget that allows you to enjoy your money while also working towards your financial future. It’s important to remember that these percentages are guidelines and can be adjusted based on your individual circumstances and priorities.

Apps to Help You Stay on Track

Staying organized and productive can be challenging. Thankfully, numerous apps are designed to help you manage your tasks, goals, and time effectively. These apps offer features such as to-do lists, calendar integration, habit trackers, and progress visualization, empowering you to stay focused and achieve your objectives.

Choosing the right app depends on your specific needs and preferences. Some popular options include productivity suites like Notion and Evernote, which offer robust features for note-taking, project management, and task organization. If you’re looking for a simpler to-do list app, consider options like Todoist, Microsoft To Do, or Any.do. For habit tracking, apps like Habitica and Streaks can help you build positive routines.

By leveraging the power of these apps, you can gain greater control over your schedule, improve your productivity, and make consistent progress towards your goals. Experiment with different apps to find the one that best fits your workflow and helps you stay on track.

Revisiting and Adjusting Monthly

It’s crucial to regularly revisit your monthly budget, expenses, and goals. Life changes, unexpected costs arise, and priorities shift. Taking the time each month to review your finances allows you to adjust and stay on track towards your financial objectives. This proactive approach helps ensure you’re making informed decisions with your money.

Begin by comparing your planned budget against your actual spending. Identify areas where you overspent or underspent. Analyze the reasons behind these discrepancies. Was it due to an unforeseen expense, a change in spending habits, or an inaccurate budget estimate? Understanding the “why” is key to making effective adjustments moving forward.

Based on your review, modify your budget for the next month. If you consistently overspend in a particular category, consider adjusting your allocated amount or finding ways to reduce spending in that area. If you have extra funds available, consider increasing contributions to savings, investments, or debt repayment. Remember, the goal is to optimize your finances to align with your evolving needs and goals.

Avoiding Budget Burnout

Budgeting is crucial for financial health, but it can also lead to burnout if not approached carefully. Consistency is key, but avoid overly restrictive budgets that eliminate all joy. Start with small, achievable goals, like tracking spending for a week or packing your lunch a few days a week. Celebrate small wins to maintain motivation and build positive reinforcement. Flexibility is also important; allow for occasional indulgences to prevent feeling deprived and ultimately abandoning the budget altogether.

Mindful spending is another important aspect of avoiding burnout. Ask yourself if a purchase truly aligns with your values and needs before making it. This conscious approach can help curb impulse purchases and foster a greater appreciation for the things you already have. Prioritize experiences and meaningful purchases over material possessions that provide only temporary satisfaction. Focusing on long-term goals, like saving for a down payment or retirement, can also provide motivation and perspective during the budgeting process.

Finally, remember to be kind to yourself. Budgeting is a journey, not a destination, and setbacks are inevitable. Don’t get discouraged by occasional slip-ups. View them as learning opportunities and adjust your budget as needed. Remember that a budget is a tool to empower you, not to restrict you. It’s about making conscious choices that align with your financial goals and values, leading to a healthier and more fulfilling financial life.