Are you looking to start investing but feeling overwhelmed by the complexities of the stock market? Index funds offer a simple, effective, and accessible entry point for beginner investors. This Beginner’s Guide to Investing in Index Funds will provide you with a comprehensive overview of what index funds are, how they work, and why they’re a smart investment choice, particularly for those just starting their investment journey. Learn how to build a diversified portfolio, minimize risk, and potentially achieve long-term financial growth with the power of index fund investing.

This guide demystifies index funds, explaining the key concepts in plain language. We’ll cover everything from understanding expense ratios and market capitalization to selecting the right index fund for your investment goals. Discover the benefits of passive investing through index funds and gain the knowledge necessary to make informed investment decisions. Whether you’re saving for retirement, a down payment on a house, or simply seeking long-term wealth accumulation, index fund investing can be a powerful tool to help you reach your financial objectives.

What Are Index Funds?

An index fund is a type of mutual fund or exchange-traded fund (ETF) with a portfolio constructed to match or track the components of a market index, such as the S&P 500. This means the fund holds the same stocks in the same proportions as the index it follows. Index funds are designed to provide broad market exposure and typically have lower expense ratios than actively managed funds.

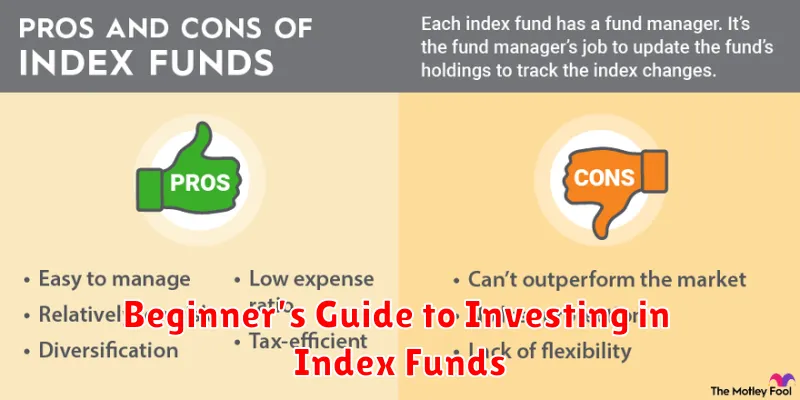

Passive management is a key feature of index funds. Unlike actively managed funds where a fund manager makes investment decisions, index funds simply replicate the holdings of the chosen index. This reduces the need for research and trading, which translates to lower costs for investors. Index funds aim to match market returns rather than outperform them.

Investing in an index fund provides a diversified portfolio with exposure to a specific market segment. For example, an S&P 500 index fund offers exposure to 500 of the largest US companies. Index funds are considered a simple and efficient way to invest in the broad market for long-term growth.

Why They’re Ideal for Beginners

For novice programmers, certain programming languages offer a gentler learning curve. These languages often feature simplified syntax, extensive documentation, and large, supportive communities. This makes them ideal for building a strong foundational understanding of programming concepts without getting bogged down in complex details. Ease of use and access to resources are key factors contributing to their suitability for beginners.

Languages like Python, for example, prioritize readability with a clean syntax, making the code easier to understand and write. JavaScript, widely used for web development, offers immediate visual feedback, which can be highly motivating for learners. These languages also boast vast online resources, including tutorials, forums, and documentation, providing ample support for beginners navigating their coding journey. The immediate application of skills and visible results contribute significantly to the learning process.

Ultimately, the “best” beginner language depends on individual learning styles and goals. However, languages with a focus on simplicity, clear documentation, and strong community support are often the most effective starting points. This allows beginners to grasp core programming principles, build confidence, and establish a solid foundation for future learning.

Popular Index Funds to Start With

Investing in index funds is a popular choice for both beginner and seasoned investors. These funds aim to track a specific market index, such as the S&P 500, offering diversification and often lower expense ratios compared to actively managed funds. By mirroring the performance of the index, they provide broad market exposure and can be a cost-effective way to build long-term wealth.

Several popular index funds are readily available to investors. Funds tracking the S&P 500 offer exposure to 500 of the largest US companies, representing a significant portion of the US stock market. Total market index funds broaden the scope by including a wider range of companies across different market capitalizations. International index funds allow investors to diversify their holdings beyond the US market, providing exposure to global equities.

When selecting an index fund, consider factors such as the expense ratio, the fund’s tracking error (how closely it follows the index), and the investment minimums. Lower expense ratios and minimal tracking error are generally desirable. It’s also crucial to align your investment choices with your overall financial goals and risk tolerance.

How to Open an Investment Account

Opening an investment account is a crucial step towards building wealth and achieving your financial goals. It provides a platform to invest in various asset classes, such as stocks, bonds, and mutual funds, allowing your money to potentially grow over time. The first step involves choosing the right type of account based on your investment objectives. Common options include taxable brokerage accounts, retirement accounts (like IRAs and 401(k)s), and education savings accounts (like 529 plans). Each account type has its own tax implications and regulations, so research is essential. Consider your investment timeline, risk tolerance, and financial situation when making your selection.

Once you’ve selected an account type, you’ll need to choose a brokerage firm or financial institution. Factors to consider include fees, available investment options, research tools, and customer support. Reputable online brokerages and established financial institutions offer comprehensive platforms for managing investments. After selecting a brokerage, you’ll complete an application process, providing personal information and verifying your identity. This process typically involves filling out an online form and submitting required documentation.

After your account is approved and opened, you can fund it through various methods, such as electronic transfers or checks. Once funded, you can begin investing in the assets of your choice. It’s highly recommended to develop an investment strategy aligned with your goals and risk tolerance. Diversifying your investments across different asset classes can help mitigate risk. Regularly monitoring your portfolio and making adjustments as needed is also important. Consulting with a qualified financial advisor can provide personalized guidance and support throughout your investment journey.

Setting Monthly Contribution Goals

Setting realistic monthly contribution goals is crucial for successful financial planning. Start by evaluating your current income and expenses. Identify areas where you can potentially reduce spending to free up more funds for contributions. Consider your long-term financial objectives, whether it’s retirement savings, buying a house, or paying off debt. These goals will influence how much you should aim to contribute each month.

A helpful strategy is to automate your contributions. Set up automatic transfers from your checking account to your investment or savings account each month. This ensures consistent contributions and removes the temptation to spend the money elsewhere. Starting small and gradually increasing your contributions over time is a sustainable approach. Even small, regular contributions can make a significant difference in the long run thanks to the power of compounding.

Remember to periodically review and adjust your contribution goals. Life changes, such as a salary increase or unexpected expenses, may require you to modify your plan. Staying flexible and adapting your goals as needed will help you stay on track towards achieving your financial objectives.

Index Funds vs Actively Managed Funds

Index funds aim to replicate the performance of a specific market index, like the S&P 500. They passively track the index by holding the same stocks in the same proportions. This results in lower expense ratios because there’s less need for active trading and research. Index funds are generally considered a lower-risk investment suitable for long-term growth.

Actively managed funds, on the other hand, employ professional fund managers who actively pick stocks and other securities with the goal of outperforming the market. These managers conduct research, analyze market trends, and make trading decisions in an attempt to maximize returns. However, this active management comes with higher expense ratios. While the goal is to outperform the market, there’s no guarantee of success, and actively managed funds can sometimes underperform their benchmarks.

Ultimately, the choice between index funds and actively managed funds depends on individual investor goals and risk tolerance. Index funds are often favored for their simplicity, low cost, and long-term growth potential. Actively managed funds may be considered by investors seeking to potentially outperform the market, but they come with higher fees and greater risk.

Understanding Long-Term Growth

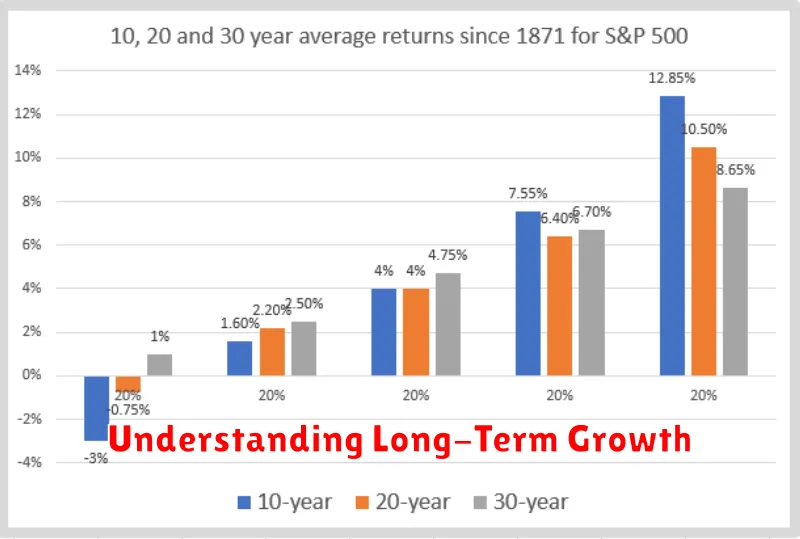

Long-term growth refers to the sustained increase in the value of an investment or asset over an extended period, typically several years or even decades. It’s a key concept for investors aiming to build wealth steadily, rather than seeking short-term gains. Factors influencing long-term growth can include economic expansion, technological advancements, and demographic shifts. Patience and a long-term perspective are crucial for achieving such growth, as markets can fluctuate significantly in the short term.

Focusing on long-term growth allows investors to ride out market volatility and benefit from the power of compounding. Compounding occurs when reinvested earnings generate their own earnings, leading to exponential growth over time. A long-term strategy also minimizes the impact of transaction costs and taxes, which can erode returns when investments are bought and sold frequently. Diversification, or spreading investments across different asset classes, is another essential element of a long-term growth strategy.

Several strategies can support long-term growth, including: investing in high-quality companies with a proven track record of innovation and growth; allocating a portion of your portfolio to emerging markets with high growth potential; and regularly rebalancing your portfolio to maintain your desired asset allocation. It’s important to remember that past performance is not indicative of future results and to consult with a financial advisor to develop a personalized investment strategy aligned with your individual goals and risk tolerance.

Tax Considerations

Taxes are a crucial aspect of any financial decision. Understanding the tax implications of investments, retirement planning, and even major purchases can significantly impact your overall financial well-being. It is essential to consider both federal and state taxes, as rates and regulations can vary considerably. Consulting with a qualified tax professional can provide personalized guidance and help you make informed decisions.

Different types of investments have different tax implications. For example, capital gains from selling stocks are taxed differently than interest earned on savings accounts. Retirement accounts like 401(k)s and IRAs offer tax advantages, but it’s important to understand the specific rules and contribution limits. Additionally, tax laws are subject to change, so staying updated on current regulations is vital.

Tax planning is not a one-time event but an ongoing process. Regularly reviewing your financial situation and adjusting your strategies as needed can help you minimize your tax liability and maximize your financial resources. Remember to keep accurate records of all income and expenses to facilitate accurate tax filing.

Python is a high-level, general-purpose programming language. Its design philosophy emphasizes code readability with the use of significant indentation. Python is dynamically typed and garbage-collected. It supports multiple programming paradigms, including structured (particularly procedural), object-oriented, and functional programming.

Due to its comprehensive standard library, Python is often described as a “batteries included” language. It features built-in data structures, along with dynamic typing and binding, making it very attractive for Rapid Application Development, as well as for use as a scripting or glue language to connect existing components together.

Python’s simple, easy to learn syntax emphasizes readability and therefore reduces the cost of program maintenance. Python supports modules and packages, which encourages program modularity and code reuse. The Python interpreter and the extensive standard library are available in source or binary form without charge for all major platforms, and can be freely distributed.

Where to Learn More

- Official Python Documentation: The official documentation provides comprehensive information about the language, libraries, and tutorials.

- Online Courses: Platforms like Coursera, edX, and Udemy offer a variety of Python courses for all skill levels.

- Books: Numerous books are available for learning Python, ranging from beginner-friendly introductions to advanced topics.