Deciding how to manage your finances is a crucial step towards achieving your financial goals. Are you considering using a financial advisor or taking the DIY planning route? This article explores the critical differences between working with a financial advisor and managing your investments yourself, weighing the pros and cons of each approach. Understanding the nuances of financial planning, investment management, and wealth management will empower you to make the best decision for your individual circumstances. We will delve into the complexities of each option, helping you determine whether the expertise of a financial advisor is necessary or if you are equipped to handle your DIY financial planning.

Choosing between professional financial advice and independent financial planning requires careful consideration of your financial situation, goals, and comfort level with managing investments. This article provides a comprehensive comparison of using a financial advisor versus DIY planning, covering key aspects such as cost, investment strategy, risk tolerance, and time commitment. By understanding the advantages and disadvantages of each approach, you can make an informed decision that aligns with your financial needs and aspirations. Whether you seek the personalized guidance of a financial advisor or prefer the autonomy of DIY investing, this article will equip you with the knowledge to navigate the complexities of financial planning and make the best choice for your future.

Pros and Cons of Using an Advisor

Advantages of utilizing an advisor often include gaining access to expert knowledge and personalized guidance. Advisors can provide valuable insights based on their experience and understanding of specific fields, whether financial, academic, or professional. They can help individuals define and achieve goals, navigate complex situations, and make informed decisions. Moreover, a good advisor offers objective perspectives and accountability, helping clients stay on track and avoid common pitfalls.

Conversely, there are some potential drawbacks to consider. Working with an advisor can be expensive, requiring fees or commissions for their services. There is also a risk of conflicts of interest, particularly in situations where the advisor may benefit financially from certain client choices. Finally, relying too heavily on an advisor can hinder the development of independent decision-making skills, leaving individuals less capable of managing their own affairs in the long term.

Ultimately, the decision of whether or not to engage an advisor is a personal one. It’s essential to carefully weigh the potential benefits against the associated costs and risks. Considering your individual needs, resources, and long-term goals will help you determine if seeking professional guidance is the right choice for you.

When DIY Financial Planning Works

DIY financial planning can be a suitable approach for individuals with straightforward financial situations and a strong understanding of personal finance principles. This generally includes those with a stable income, manageable debt, and clear financial goals like saving for retirement or a down payment on a house. Comfort with using budgeting tools, investment platforms, and researching financial topics independently is also crucial. DIY planners must be disciplined enough to regularly review their progress and make adjustments as needed.

Several scenarios lend themselves well to a DIY approach. For example, young professionals just starting out, with limited assets and relatively simple financial needs, might find managing their finances on their own perfectly adequate. Similarly, individuals who are comfortable with online resources and have a good grasp of basic investment strategies can often handle their own retirement planning. However, it’s important to recognize the limitations of DIY planning and seek professional guidance when complexity increases.

As financial situations become more intricate, involving elements like estate planning, complex tax situations, or significant investment portfolios, the need for professional advice becomes more pronounced. While DIY planning can be cost-effective in the short term, mistakes made early on can have significant long-term consequences. Therefore, recognizing when to transition from self-management to professional guidance is a crucial aspect of responsible financial planning.

Fee-Only vs. Commission-Based Advisors

Fee-only financial advisors are compensated solely by the fees their clients pay. This can take several forms, such as a percentage of assets under management, hourly rates, fixed project fees, or retainer fees. Because their compensation isn’t tied to product sales, fee-only advisors are generally considered to have fewer conflicts of interest. This structure incentivizes them to focus solely on their client’s best interests and provide unbiased advice.

Commission-based advisors, on the other hand, earn their income through commissions generated from selling financial products, like insurance policies or mutual funds. While this model can be cost-effective for those needing specific products, it can potentially create conflicts of interest. The advisor might be motivated to recommend products that yield higher commissions, even if other options might be more beneficial for the client. Transparency regarding commission structures is crucial when working with commission-based advisors.

Ultimately, the best choice depends on individual circumstances and preferences. Clients should carefully evaluate their needs, understand how their advisor is compensated, and consider potential conflicts of interest before making a decision. Understanding the difference between these two compensation models is crucial for making an informed choice when selecting a financial advisor.

What Services Do Advisors Offer?

Financial advisors offer a range of services designed to help individuals and businesses achieve their financial goals. These services often include investment management, where advisors create and manage personalized investment portfolios based on a client’s risk tolerance, time horizon, and financial objectives. They also provide financial planning, encompassing areas such as retirement planning, estate planning, tax planning, and education planning. Advisors offer guidance and support to help clients make informed financial decisions.

Beyond these core services, many advisors also offer specialized expertise in areas like insurance planning, debt management, or business succession planning. Some advisors cater to specific demographics, such as high-net-worth individuals or small business owners. The specific services offered can vary significantly depending on the advisor’s qualifications, experience, and the type of firm they work for.

Engaging a financial advisor often begins with a consultation to discuss financial goals and needs. This allows the advisor to understand the client’s situation and recommend appropriate services. The advisor and client will then agree upon the scope of services and the associated fees. Ongoing communication and regular reviews are crucial elements of the advisor-client relationship to ensure that the financial plan remains aligned with the client’s evolving circumstances.

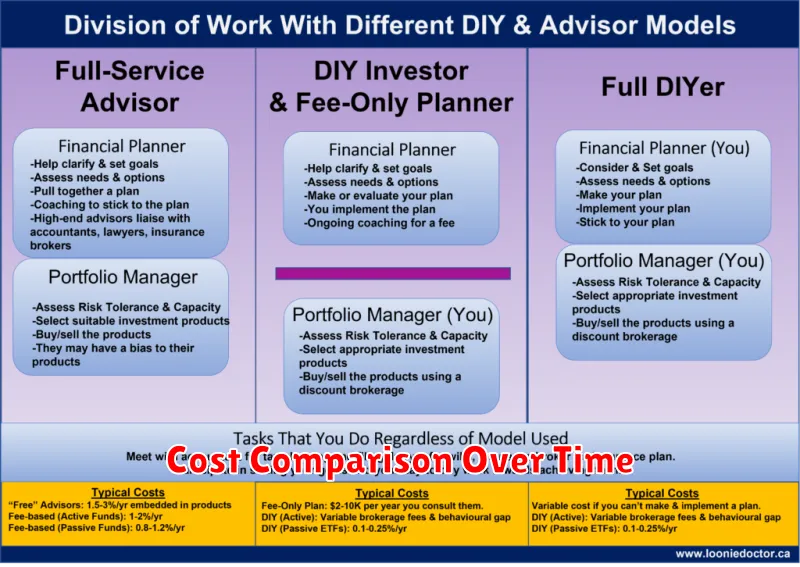

Cost Comparison Over Time

Analyzing costs over time is crucial for understanding trends, identifying potential savings, and making informed business decisions. This analysis can reveal the impact of inflation, changes in demand, technological advancements, and other factors influencing expenses. By tracking costs historically, businesses can better predict future expenses and allocate resources effectively.

Several methods exist to compare costs across different periods. Direct comparison involves examining the absolute cost values for each time period. Indexing, another approach, expresses costs relative to a base period, providing a standardized view of changes over time. Percentage change calculations highlight the rate of increase or decrease in costs between periods. Choosing the right method depends on the specific analysis goals and the nature of the data.

Key factors to consider when conducting a cost comparison over time include data accuracy, consistency of measurement, and the impact of external factors like economic conditions and industry trends. It is essential to account for these factors to ensure accurate and meaningful comparisons.

Robo-Advisors as a Middle Ground

Robo-advisors offer a compelling middle ground between traditional, full-service financial advisors and a completely do-it-yourself approach to investing. They provide automated portfolio management based on your risk tolerance and financial goals, often at a lower cost than traditional advisors. This makes them particularly attractive to beginning investors or those with limited capital who may not qualify for the services of a traditional advisor. Robo-advisors typically utilize exchange-traded funds (ETFs) to create diversified portfolios, automatically rebalancing them periodically to maintain the desired asset allocation.

While robo-advisors offer convenience and affordability, they do have limitations. The level of personalization is generally less than what you would receive from a human advisor. Complex financial situations may require more nuanced advice that an algorithm cannot provide. Furthermore, while some robo-advisors offer access to human advisors, this often comes at an additional cost. Choosing the right robo-advisor requires careful consideration of factors such as fees, investment options, and available features.

Ultimately, deciding whether a robo-advisor is right for you depends on your individual needs and circumstances. If you’re comfortable with technology, seeking a low-cost solution, and looking for a hands-off approach to investing, a robo-advisor might be a good fit. However, if you require highly personalized financial planning or have a complex financial situation, a traditional human advisor might be a better choice.

How to Vet a Financial Advisor

Choosing the right financial advisor is a crucial step towards achieving your financial goals. Start by understanding their credentials. Look for designations like Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Public Accountant (CPA), which indicate a commitment to professional standards and continuing education. Verify these credentials through reputable organizations like the CFP Board or the CFA Institute. Also, inquire about their experience, specifically the types of clients they typically serve and their expertise in areas relevant to your needs.

Next, assess their fee structure. Transparency is key. Understand how the advisor is compensated, whether it’s through commissions, fees based on assets under management (AUM), or hourly rates. Compare these fees with industry averages and be wary of advisors who are vague about their compensation. It’s equally important to understand the advisor’s investment philosophy. Ask about their approach to risk management and how they tailor investment strategies to individual client goals. Ensure their philosophy aligns with your own comfort level and long-term objectives. Ask for and check references to gain insights from other clients.

Finally, confirm they are a fiduciary. A fiduciary advisor is legally obligated to act in your best interest. This is a critical distinction and provides an added layer of protection. Don’t hesitate to ask direct questions about potential conflicts of interest and how they are managed. Choosing a financial advisor is a significant decision. By taking the time to thoroughly vet potential advisors, you can increase the likelihood of a successful and productive long-term relationship.

When to Consider a Switch

Knowing when to switch jobs can be tricky. There are several key indicators that suggest it might be time for a change. If you’re consistently feeling unfulfilled, undervalued, or lacking growth opportunities in your current role, it’s a good sign to start exploring other options. Additionally, a toxic work environment, poor management, or consistent work-life imbalance are strong reasons to consider a switch. Finally, if your career goals have shifted or you’re simply ready for a new challenge, exploring a job change can be a positive step forward.

Beyond these internal factors, external factors like limited salary growth potential or a lack of job security in your current company can also be compelling reasons to consider a switch. Perhaps the industry is changing, and your company isn’t adapting, or maybe you’ve identified better opportunities elsewhere with stronger compensation packages and more room for advancement. These are practical considerations that warrant exploring alternative employment options.

Ultimately, the decision to switch jobs is a personal one. Weigh the pros and cons carefully, considering both your short-term and long-term career goals. If you find that the negative aspects of your current role significantly outweigh the positives and are impacting your overall well-being, it’s likely time to make a change.