Planning for early retirement in your 50s requires a proactive and strategic approach. Many individuals dream of retiring early, but achieving this goal necessitates careful financial planning and disciplined execution. This article will provide valuable insights into the essential steps needed to successfully navigate the path towards early retirement in your 50s, enabling you to enjoy a fulfilling and financially secure future. Understanding your current financial standing, defining your retirement goals, and implementing effective strategies are crucial for achieving financial independence and enjoying the benefits of early retirement.

Early retirement offers the promise of increased freedom and flexibility, allowing you to pursue passions, travel, and spend quality time with loved ones. However, embarking on this journey demands a comprehensive understanding of your financial landscape. From assessing your current savings and investments to projecting your retirement expenses and managing potential risks, careful planning is paramount. This guide will delve into the key aspects of preparing for early retirement in your 50s, covering topics such as aggressive saving strategies, investment management, healthcare planning, and creating a sustainable retirement income stream. By addressing these critical components, you can increase your chances of achieving a comfortable and secure early retirement.

Why Planning Ahead Is Essential

Planning ahead is crucial for success in various aspects of life. It allows you to anticipate potential challenges, allocate resources effectively, and make informed decisions. Without a plan, you’re more likely to encounter unexpected obstacles, waste time and resources, and ultimately fall short of your goals. Whether it’s a project at work, a personal endeavor, or a long-term financial strategy, proactive planning provides a roadmap for achieving desired outcomes.

The benefits of planning extend beyond simply avoiding problems. A well-defined plan allows for greater efficiency by streamlining processes and prioritizing tasks. This, in turn, leads to increased productivity and better time management. Furthermore, planning encourages a proactive mindset, fostering a sense of control and reducing stress associated with uncertainty. By considering potential scenarios and developing contingency plans, you’ll be better equipped to handle unexpected situations and adapt to changing circumstances.

In today’s rapidly changing world, adaptability is essential. While detailed long-term plans may need adjustments along the way, the core principle of planning ahead remains vital. It provides a framework for decision-making, promotes a sense of purpose, and increases the likelihood of achieving both short-term and long-term goals. Investing time in planning is an investment in your future success.

Understanding FIRE and Its Variants

FIRE (Financial Independence, Retire Early) is a financial movement with the goal of gaining financial independence and retiring much earlier than the traditional retirement age. This is achieved through aggressive saving and investing, often aiming to save and invest 50% or more of one’s income. The core principle is to grow investments to a point where they generate enough passive income to cover living expenses, allowing for early retirement. FIRE adherents typically track their progress towards their FIRE number, which represents the total amount of invested assets needed to sustainably withdraw and cover expenses.

Several FIRE variants exist, catering to different lifestyles and financial goals. Lean FIRE emphasizes frugality and a lower cost of living, requiring a smaller nest egg. Fat FIRE, conversely, aims for a more luxurious retirement and thus requires a significantly larger investment portfolio. Barista FIRE involves retiring from a traditional career but continuing to work part-time or in a less demanding role to supplement passive income and maintain health insurance. Coast FIRE involves reaching a portfolio size where projected growth alone, without further contributions, will reach the desired FIRE number by traditional retirement age.

Regardless of the chosen FIRE path, careful planning and consideration are crucial. A comprehensive financial plan should include a detailed budget, investment strategy, and contingency plans for unexpected expenses or market downturns. It’s important to understand the risks associated with early retirement, such as longevity risk and the potential impact of inflation on long-term financial security. Seeking professional financial advice is recommended to develop a personalized FIRE plan that aligns with individual circumstances and goals.

Reviewing Your Investment Strategy

Regularly reviewing your investment strategy is crucial for long-term financial success. Market conditions, personal circumstances, and financial goals can change over time, necessitating adjustments to your portfolio. A thorough review should involve analyzing your current asset allocation, evaluating the performance of your investments, and reassessing your risk tolerance. This process allows you to identify potential weaknesses and opportunities for improvement, ensuring your investments remain aligned with your overall financial objectives. For example, a shift in your risk tolerance from moderate to conservative might require adjusting your portfolio to include more fixed-income securities.

The frequency of your reviews depends on your individual needs and the complexity of your investments. However, a general guideline is to conduct a comprehensive review at least annually. More frequent monitoring may be necessary during periods of significant market volatility or life changes such as marriage, retirement, or the birth of a child. These events can significantly impact your financial goals and require adjustments to your investment strategy. Regular reviews enable you to adapt to these changes and maintain a portfolio that reflects your current situation and objectives.

When conducting your review, consider factors like your time horizon, investment goals, and tax implications. Consulting with a qualified financial advisor can provide valuable insights and guidance, especially for complex investment strategies. They can help you objectively assess your portfolio’s performance, identify potential risks and opportunities, and make informed decisions about your future investments. Remember, a well-defined and regularly reviewed investment strategy is essential for achieving your financial goals.

Health Insurance and Coverage

Health insurance provides financial protection against the high costs of medical care. It covers expenses such as doctor visits, hospital stays, prescription drugs, and preventive care. Having health insurance is crucial for managing unexpected medical expenses and ensuring access to necessary care. By paying a regular premium, individuals and families gain access to a network of healthcare providers and services at a reduced cost.

There are various types of health insurance plans available, each with different levels of coverage and costs. Common plan types include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Point of Service (POS) plans. Understanding the differences between these plans, such as network restrictions and cost-sharing requirements (copays, deductibles, and coinsurance), is essential for choosing the plan that best meets individual needs and budget.

Coverage refers to the specific medical services and treatments included in a health insurance plan. It is important to carefully review a plan’s coverage documents to understand what is included and excluded. Common coverage areas include hospitalization, emergency services, maternity care, mental health services, and prescription drug benefits. Understanding the scope of coverage can help individuals make informed decisions about their healthcare and avoid unexpected expenses.

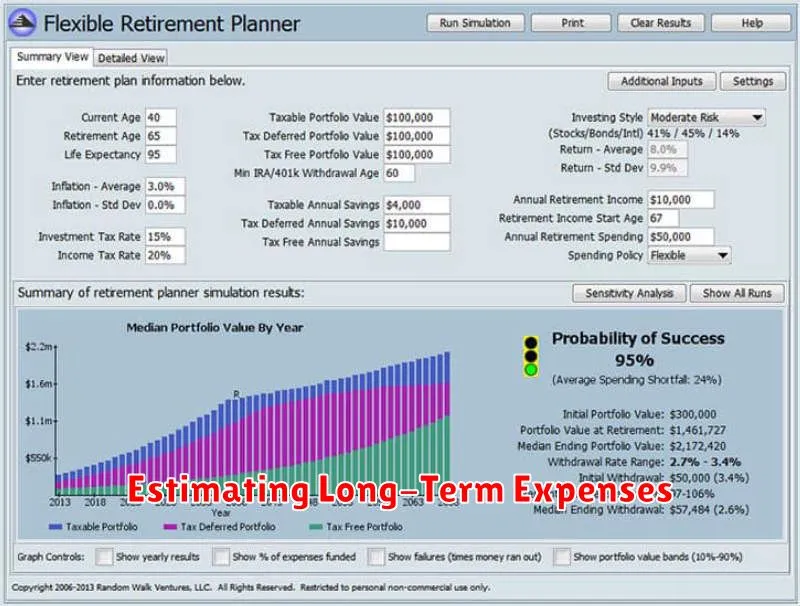

Estimating Long-Term Expenses

Estimating long-term expenses is crucial for effective financial planning. It allows you to prepare for significant future costs like retirement, education, or a home purchase. Start by identifying potential expenses. Consider factors such as inflation and rising costs of living. Be realistic and factor in unexpected events or emergencies.

Various methods can help refine your estimations. Past spending habits offer valuable insights, especially when coupled with projected future needs. Online calculators and financial planning tools can also provide helpful estimates based on various factors like age, income, and desired lifestyle. Consulting with a financial advisor can offer personalized guidance and expertise for a more comprehensive and tailored approach.

Regularly reviewing and adjusting your estimations is essential. Life changes, economic conditions fluctuate, and your goals may evolve. By staying proactive and adapting your projections, you can maintain a more accurate picture of your long-term financial outlook and make informed decisions to secure your future.

Real Estate as Passive Income

Real estate can be a powerful tool for generating passive income. Rental properties are a common example, providing consistent monthly cash flow from tenants. Other avenues include REITs (Real Estate Investment Trusts), which allow you to invest in a portfolio of properties without direct ownership, and real estate crowdfunding platforms offering fractional ownership in various developments. However, it’s important to remember that “passive” doesn’t mean “effortless.” Managing properties or researching investments still requires time and due diligence.

Several factors contribute to the potential profitability of real estate as passive income. Location significantly impacts rental demand and property value appreciation. Property type, whether residential, commercial, or industrial, influences the potential return and associated risks. Finally, effective property management is crucial for maximizing income by minimizing vacancies and maintaining property value. Thoroughly analyzing these factors is essential for successful real estate investment.

While real estate offers attractive passive income possibilities, risks exist. Market fluctuations can impact property values, and unexpected repairs or tenant issues can reduce cash flow. Due diligence, including careful market research and property inspection, is crucial to mitigating these risks. Consider seeking advice from experienced real estate professionals and financial advisors before investing.

Minimizing Taxes in Retirement

Managing taxes in retirement is crucial for maximizing your income. One key strategy is to diversify your retirement accounts. Having a mix of tax-deferred accounts (like traditional 401(k)s and IRAs), tax-free accounts (like Roth IRAs and Roth 401(k)s), and taxable brokerage accounts allows for flexibility in managing withdrawals and minimizing your overall tax liability. Strategically withdrawing from different account types at different times can significantly impact how much you pay in taxes each year.

Understanding the tax implications of different income sources is also essential. Social Security benefits, pensions, and withdrawals from retirement accounts are often taxed differently. For example, a portion of your Social Security benefits may be taxable depending on your combined income. Being aware of these rules and planning accordingly can help you minimize your tax burden. Consider consulting with a financial advisor to develop a personalized tax strategy based on your specific situation and income sources.

Finally, be mindful of state taxes. Some states offer more favorable tax treatment of retirement income than others. If you are considering relocating in retirement, researching state tax laws is a critical factor in your decision-making process. Factors like property taxes, sales taxes, and income tax rates can all have a significant impact on your retirement budget.

Adjusting Lifestyle to Save More

Saving money often requires adjustments to our daily habits. Evaluate your spending and identify areas where you can cut back. This might involve brewing your own coffee instead of buying it daily, packing lunches instead of eating out, or reducing subscription services you don’t frequently use. Small changes can add up to significant savings over time.

Creating a budget is crucial for effectively managing your finances. Track your income and expenses to gain a clear understanding of where your money is going. Prioritize essential expenses like housing, utilities, and groceries, then allocate funds for other needs and wants. Sticking to a budget helps you control your spending and ensures you’re consistently saving towards your financial goals.

Explore ways to increase your income to boost your savings potential. This could involve negotiating a raise at your current job, taking on a side hustle, or selling unused items. Every extra dollar earned can contribute to your savings and help you reach your financial milestones faster.

Building a Withdrawal Strategy

A successful retirement requires a well-defined withdrawal strategy to ensure your savings last. This involves determining how much you can safely withdraw each year without depleting your funds prematurely. Key factors to consider include your estimated lifespan, investment portfolio returns, inflation, and anticipated expenses. A sustainable withdrawal rate, often cited around 4%, aims to balance income needs with portfolio longevity. It’s crucial to remember that this is a general guideline and personalized advice from a financial advisor is recommended.

Several withdrawal strategies exist, each with pros and cons. The fixed-dollar method withdraws a consistent amount annually, providing predictable income but potentially losing purchasing power due to inflation. The fixed-percentage method adjusts withdrawals based on portfolio performance, offering flexibility but potentially reducing income during market downturns. A hybrid approach combines elements of both, aiming for stable income while adjusting for inflation and portfolio fluctuations.

Regularly reviewing and adjusting your withdrawal strategy is essential. Life changes, market shifts, and unexpected expenses can impact your financial needs. By remaining flexible and adaptable, you can help ensure your retirement income remains sustainable throughout your retirement years.