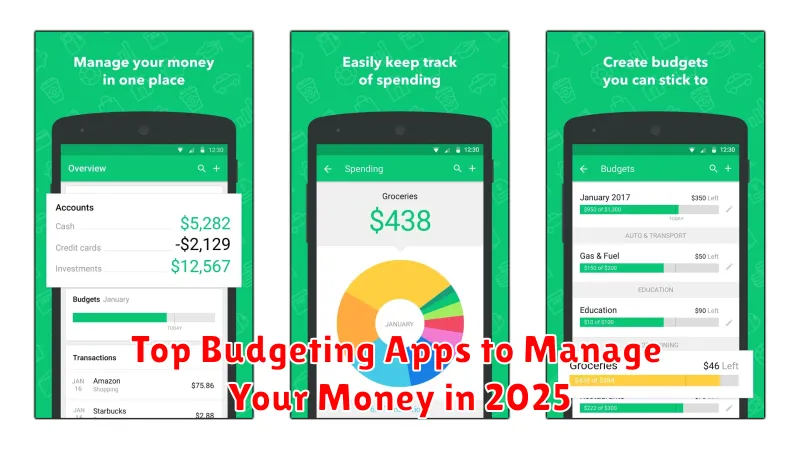

Managing your finances effectively is crucial in today’s dynamic economic landscape. In 2025, leveraging technology through budgeting apps can significantly empower you to take control of your money management. Whether you’re aiming to save for a down payment, eliminate debt, or simply gain a clearer understanding of your spending habits, the right budgeting app can be an invaluable tool. This article will explore the top budgeting apps available in 2025, highlighting their key features and benefits to help you choose the perfect one to meet your financial goals.

Finding the ideal personal finance solution can be challenging with the multitude of budgeting apps on the market. This comprehensive guide will break down the best budgeting apps of 2025, considering factors such as user-friendliness, features, security, and pricing. From robust expense trackers to sophisticated investment tools, we’ll cover a range of options suitable for various money management needs and tech savviness. Discover which top budgeting apps will empower you to achieve your financial goals in 2025 and beyond.

Why Budgeting Apps Are Essential Today

In today’s fast-paced world, managing finances effectively is crucial. Budgeting apps provide a convenient and powerful way to track income and expenses, offering real-time insights into your spending habits. These tools empower users to make informed financial decisions, promoting better money management and helping to achieve financial goals. The automation features of these apps, such as transaction categorization and bill payment reminders, significantly reduce the time and effort traditionally associated with manual budgeting.

Budgeting apps offer a variety of essential features that contribute to improved financial health. These include personalized budgeting plans, visual representations of spending patterns, and goal-setting tools. Many apps also offer features like fraud alerts and credit score monitoring, providing a holistic overview of one’s financial standing. The ability to access and manage finances from anywhere with a smartphone or other mobile device further enhances the accessibility and convenience of these apps.

Utilizing a budgeting app is a proactive step towards achieving financial stability and long-term financial well-being. By providing a clear picture of income and expenses, these apps empower users to identify areas for improvement, reduce unnecessary spending, and allocate funds more effectively. Whether saving for a down payment, paying off debt, or simply gaining better control over daily spending, a budgeting app can be an invaluable tool for anyone looking to improve their financial health.

Key Features to Look For

When evaluating any product or service, discerning consumers should prioritize key features that indicate quality, value, and suitability for their needs. Functionality is paramount; the product must effectively perform its intended purpose. Closely related is reliability; consistent performance over time is crucial. Finally, usability should not be overlooked. A product, regardless of its power or sophistication, must be user-friendly and accessible.

Beyond core functionality, consider factors such as durability, particularly for physical goods. A durable product withstands wear and tear, offering a longer lifespan and better return on investment. Customer support is also a vital consideration. Responsive and helpful customer service can make a significant difference, especially when troubleshooting issues or seeking assistance. Lastly, price must be factored into the decision-making process. Evaluate the product’s features and benefits in relation to its cost to determine its overall value proposition.

Ultimately, identifying key features depends on individual needs and priorities. However, considering these fundamental elements ensures a comprehensive evaluation process, leading to a more informed and satisfactory purchasing decision. Prioritizing functionality, reliability, usability, durability, customer support, and price allows consumers to make smart choices and maximize their investment.

Best Apps for Beginners

Starting something new can be daunting, but thankfully, there are numerous apps designed to simplify the process and guide beginners. Whether you’re learning a language, picking up a new instrument, or trying to improve your fitness, these apps offer structured lessons, personalized feedback, and easy-to-understand interfaces. Many also provide interactive exercises and track your progress, motivating you to continue learning and improving.

For language learning, apps like Duolingo and Babbel are excellent choices. They offer bite-sized lessons covering vocabulary, grammar, and pronunciation. Fitness apps like Nike Training Club and Couch to 5k provide structured workout plans and guidance for all fitness levels. If you’re interested in learning an instrument, apps like Yousician and Simply Piano offer interactive lessons and feedback on your playing. These are just a few examples, and exploring different options will help you find the perfect fit for your specific needs and learning style.

When choosing an app for beginners, consider factors such as the app’s user interface, the quality of the content, and the availability of personalized feedback. Look for apps with clear instructions, engaging content, and features that help you track your progress. Most apps offer free trials or limited free versions, allowing you to test them out before committing to a paid subscription.

Apps for Families and Couples

Numerous apps are designed to improve family and couple dynamics. These apps can address various needs, from communication and shared calendars to co-parenting and relationship enrichment. Choosing the right app depends on the specific needs and goals of the family or couple. Some popular categories include shared task management, budgeting tools, and location sharing for safety and coordination.

Communication-focused apps often feature secure messaging, shared photo albums, and even video chat capabilities. They can be particularly useful for families separated by distance or couples with busy schedules. Co-parenting apps offer features like shared custody calendars, expense tracking, and messaging platforms specifically designed for productive communication between separated parents. Relationship apps can provide conversation starters, relationship advice, and tools for tracking shared goals and appreciating each other.

When selecting an app, consider factors like privacy, cost, and platform compatibility. Read reviews and try out free versions or trial periods before committing to a paid subscription. The effectiveness of these apps ultimately depends on the willingness of family members or partners to actively engage with the features and incorporate them into their daily lives.

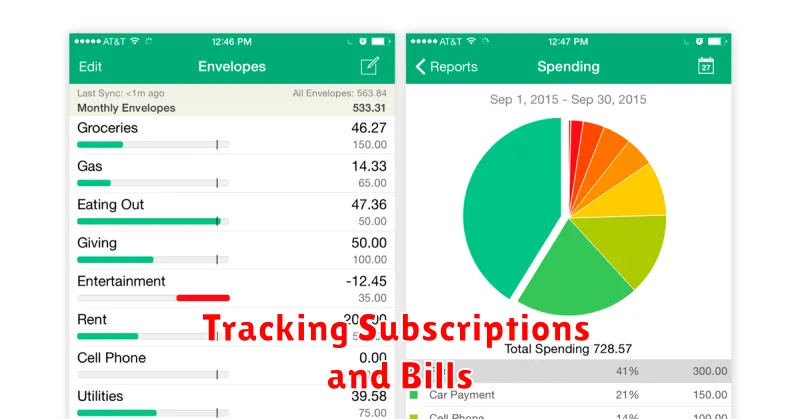

Tracking Subscriptions and Bills

Managing personal finances effectively involves staying on top of recurring expenses. Tracking subscriptions and bills allows you to understand where your money is going, avoid late fees, and identify potential areas for savings. By consistently monitoring these expenses, you gain a clearer picture of your overall financial health and can make informed decisions about your spending.

Several methods exist for tracking subscriptions and bills. You can use a dedicated budgeting app, a spreadsheet, or even a simple notebook. The key is to choose a method that works for you and stick with it. Record the due date, amount, and payment method for each bill and subscription. Regularly review your records to identify any discrepancies or potential savings opportunities.

Proactively managing subscriptions and bills helps you avoid overspending and maintain control of your finances. Once you have a system in place, periodically review your subscriptions to see if there are any you no longer need or use. Negotiating lower rates or switching to less expensive alternatives can also lead to significant savings over time.

Syncing with Bank Accounts

Syncing your accounts allows you to automatically import your transaction data into budgeting or financial management software. This provides a real-time view of your finances, making it easier to track spending, manage budgets, and identify potential financial issues.

The syncing process typically involves connecting your bank account credentials (username and password) securely through a third-party aggregator. This aggregator acts as a bridge between your bank and the software, retrieving transaction data while adhering to strict security protocols. Security is paramount, and reputable financial software employs encryption and other measures to protect your sensitive information.

Once connected, transactions are usually updated daily or even multiple times per day. This frequency ensures you have the most up-to-date overview of your financial status. Remember to regularly review connected accounts and permissions to maintain control over your data.

Data Privacy and Security

Data privacy focuses on the proper handling of data – consent, notice, and regulatory obligations. It determines what data can be collected, how it should be used, and who has access to it. Data security, on the other hand, concerns the protection of data from unauthorized access and use. This includes implementing safeguards like encryption, access controls, and incident response plans to prevent data breaches and ensure data integrity.

Both privacy and security are crucial for building and maintaining trust. Organizations must demonstrate their commitment to protecting user data through robust policies and practices. Neglecting either aspect can lead to severe consequences, including reputational damage, financial losses, and legal penalties. Prioritizing data privacy and security is essential for responsible data management.

Key areas to consider include: Data minimization (collecting only necessary data), data masking (hiding sensitive data elements), and regular security audits (assessing vulnerabilities and ensuring effectiveness of security measures). These practices, along with clear communication and transparency, contribute to a stronger security posture and build user confidence.

Free vs Paid Apps

Choosing between free and paid apps often involves weighing features against cost. Free apps are readily accessible and allow users to try before committing financially. However, they frequently include advertisements, may offer limited functionality, and might collect more user data. Cost is the primary differentiator, with free apps being obviously more budget-friendly upfront.

Paid apps, on the other hand, typically offer a more comprehensive experience. They often boast advanced features, a cleaner interface without ads, and enhanced privacy protections. The trade-off is the upfront purchase price. Deciding which is best depends on the individual user’s needs and budget. Sometimes, free versions are sufficient, while in other instances, the enhanced functionality of a paid app is worth the investment.

Key factors to consider include the frequency of use, the importance of features, and your sensitivity to ads. For infrequently used apps, a free version might suffice. However, for essential apps used daily, a paid version might be a better long-term investment for a smoother, more powerful experience.

Tips to Stay Consistent

Consistency is key to achieving long-term goals, whether it’s related to fitness, work, or personal development. One of the most effective ways to stay consistent is to start small and build momentum. Don’t try to overhaul your entire life overnight. Instead, focus on making small, manageable changes that you can stick with over time. For example, if you want to start exercising regularly, begin with just 15 minutes a day and gradually increase the duration and intensity as you get stronger. Setting realistic expectations is crucial, as trying to do too much too soon can lead to burnout and discouragement.

Another important tip is to schedule your activities and treat them like important appointments. Just as you wouldn’t miss a meeting with your boss, you shouldn’t skip your workout or study session. Blocking out specific times in your day or week for your chosen activity helps to prioritize it and makes it less likely that you’ll find excuses to avoid it. Additionally, tracking your progress can be a powerful motivator. Use a journal, app, or spreadsheet to monitor your accomplishments and celebrate your milestones. Seeing how far you’ve come can help you stay focused and motivated when you’re feeling tempted to give up.

Finally, remember that consistency isn’t about perfection. There will be days when you miss a workout, slip up on your diet, or fail to meet your goals. The key is to not let these setbacks derail your progress. Acknowledge the slip-up, learn from it, and get back on track as soon as possible. Self-compassion is essential for maintaining consistency in the long run. Don’t beat yourself up over occasional missteps. Instead, focus on the overall trend of your progress and keep moving forward.

Which App Fits Your Lifestyle?

Choosing the right app can feel overwhelming with so many options available. To simplify your decision, consider your needs and lifestyle. Are you looking for a fitness tracker, a productivity booster, or a social connection platform? Identifying your primary goal will help narrow down the choices. Think about your daily routine and how an app can seamlessly integrate into it. Do you need something to use on your commute, during workouts, or in your downtime?

Once you’ve identified your needs, research apps that cater to them. Look at reviews and ratings to gauge user experiences. Consider the app’s features and interface. Is it easy to navigate and understand? Does it offer the specific tools or information you’re looking for? Don’t be afraid to try out a few different apps before committing to one. Most offer free trials or freemium versions, allowing you to explore their functionalities firsthand.

Ultimately, the best app is the one you’ll actually use. A feature-packed app is useless if it’s too complicated or doesn’t fit into your lifestyle. Choose an app that you find enjoyable and intuitive, and that effectively addresses your specific needs. This will ensure that you get the most value and benefit from the technology.