Planning for a secure retirement requires careful consideration of various investment strategies. A Roth IRA (Individual Retirement Account) stands out as a powerful tool for long-term retirement planning, offering unique tax advantages and flexibility. This article will guide you through the essential aspects of using a Roth IRA, helping you understand how it works, its benefits, and how to effectively incorporate it into your retirement plan. Learn how to maximize your retirement savings with the tax-free growth potential of a Roth IRA. Explore the contribution limits, income restrictions, and withdrawal rules to determine if a Roth IRA is the right choice for you and your retirement planning goals.

Unlock the potential of tax-free withdrawals in retirement by understanding the intricacies of a Roth IRA. This comprehensive guide will cover everything from eligibility requirements and investment options to strategies for maximizing contributions and navigating Roth conversions. Whether you’re a seasoned investor or just beginning to plan for retirement, discover how a Roth IRA can help you achieve your financial objectives and secure a comfortable future. We’ll delve into the key differences between a Roth IRA and a Traditional IRA, empowering you to make informed decisions about your retirement planning strategy. Learn how to leverage the power of a Roth IRA for a more secure and financially fulfilling retirement.

What Is a Roth IRA?

A Roth IRA (Individual Retirement Account) is a retirement savings account that offers significant tax advantages. Contributions are made with after-tax dollars, meaning you’ve already paid income taxes on the money you deposit. The key benefit is that your qualified withdrawals in retirement, including both contributions and earnings, are tax-free.

Unlike traditional IRAs, Roth IRAs do not offer a tax deduction for contributions. However, the tax-free withdrawals in retirement can be particularly advantageous if you anticipate being in a higher tax bracket later in life. There are also certain eligibility requirements based on your income. Roth IRAs offer flexibility, allowing you to withdraw your contributions at any time without penalty. However, withdrawing your earnings before age 59 1/2 may result in taxes and a 10% penalty unless certain exceptions apply.

It’s important to consider your individual circumstances, including your current and projected income, retirement goals, and risk tolerance, when deciding whether a Roth IRA is the right choice for you.

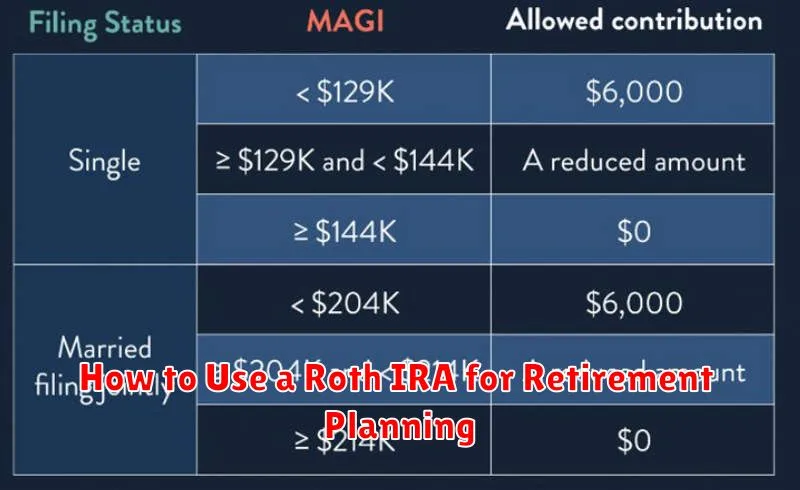

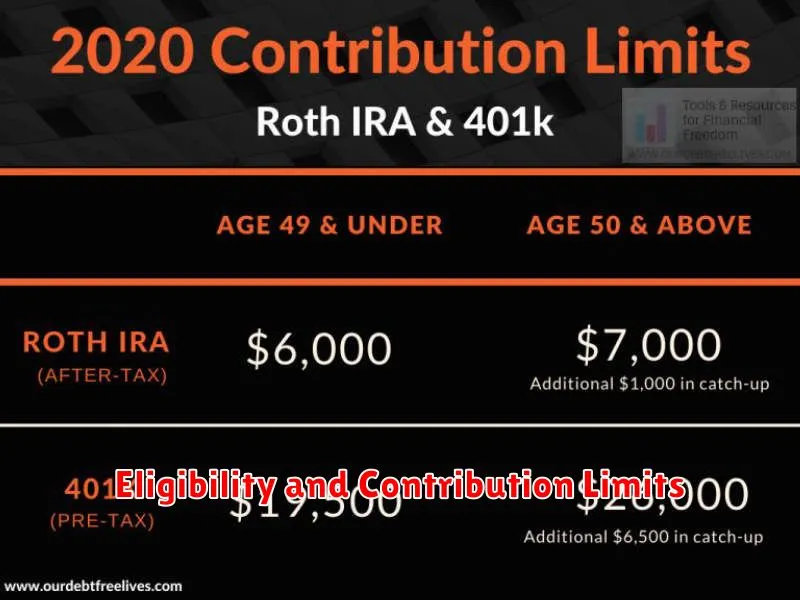

Eligibility and Contribution Limits

Eligibility for contributing to a 401(k) plan is typically determined by your employer. Most plans require you to be an employee of the company sponsoring the plan. Some plans may also have age requirements or minimum service requirements, such as working for the company for a specified period of time. It is essential to check with your employer or plan administrator for the specific eligibility requirements of your company’s 401(k) plan.

Contribution limits are established annually by the IRS. These limits apply to the total amount of contributions you can make to your 401(k) account in a given year. There are separate limits for employee contributions and combined employer and employee contributions. These limits are subject to change each year, so it’s important to stay up-to-date on the current regulations. Exceeding these contribution limits may result in penalties.

For 2023, the elective deferral (employee contribution) limit is $22,500. If you are age 50 or older, you can make additional “catch-up” contributions. The catch-up contribution limit for 2023 is an additional $7,500, for a total contribution limit of $30,000. The overall limit on contributions (including employer contributions, employee contributions, and forfeitures) for 2023 is $66,000.

Tax Advantages Explained

Tax advantages, also known as tax benefits, refer to provisions in the tax code that reduce a taxpayer’s overall liability. These advantages can take various forms, including deductions, credits, exclusions, and exemptions. They are often implemented by governments to incentivize specific behaviors, such as investing in renewable energy, charitable giving, or saving for retirement. Understanding these advantages is crucial for individuals and businesses seeking to minimize their tax burden and maximize their financial resources.

Deductions lower taxable income by subtracting specific expenses, while credits directly reduce the tax owed. Exclusions remove certain types of income from taxation altogether, and exemptions reduce taxable income based on factors like filing status and number of dependents. The impact of each type of tax advantage varies, and some may be more beneficial than others depending on an individual’s or business’s specific circumstances.

Careful tax planning is essential to leverage available tax advantages effectively. Consulting with a qualified tax professional can provide personalized guidance on identifying and utilizing appropriate tax strategies to achieve optimal tax efficiency. This professional advice can be invaluable in navigating the complexities of the tax code and ensuring compliance with all applicable regulations.

Roth IRA vs Traditional IRA

Choosing between a Roth IRA and a Traditional IRA is a crucial decision for retirement savers. The core difference lies in how they are taxed. With a Traditional IRA, contributions are often tax-deductible in the year they are made, lowering your taxable income. However, withdrawals in retirement are taxed as ordinary income. Conversely, contributions to a Roth IRA are made with after-tax dollars, meaning you don’t get an upfront tax break. The advantage comes in retirement, where withdrawals are completely tax-free.

Which type of IRA is better for you depends largely on your current and projected future tax bracket. If you anticipate being in a higher tax bracket in retirement than you are now, a Roth IRA is generally the more advantageous choice. This is because you’ll pay taxes on your contributions at your lower current rate and enjoy tax-free withdrawals in retirement when your rate is higher. If you expect to be in a lower tax bracket in retirement, a Traditional IRA might be more beneficial, allowing you to deduct contributions at your higher current rate and pay taxes on withdrawals at a lower rate later.

Other factors to consider include your income limits (higher earners may not be eligible for a Roth IRA), your current financial needs (deductible Traditional IRA contributions can provide immediate tax savings), and your overall retirement plan. Consulting with a qualified financial advisor can help you determine the best strategy for your individual circumstances.

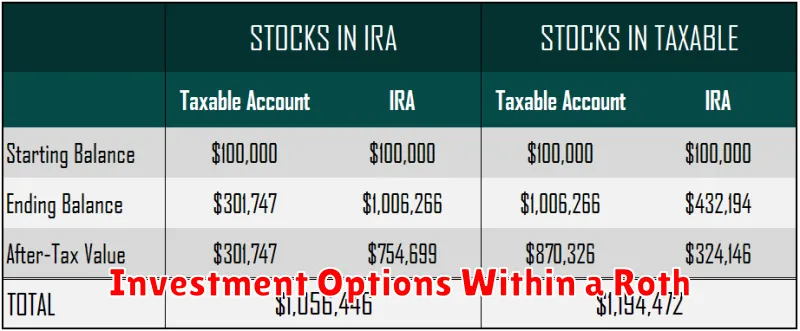

Investment Options Within a Roth

A Roth IRA offers a variety of investment options, allowing you to tailor your portfolio to your specific risk tolerance and financial goals. Common investments include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and certificates of deposit (CDs). You can choose individual stocks or bonds for more direct control, or opt for diversified investments like mutual funds or ETFs that pool money from multiple investors. The flexibility of a Roth allows you to adjust your investment strategy as your needs change over time.

Stocks offer the potential for higher growth but come with increased risk. Bonds provide more stability but typically yield lower returns. Mutual funds and ETFs offer diversification and professional management, making them suitable for investors with less experience. CDs are low-risk, fixed-income investments ideal for preserving capital.

It’s crucial to research and understand the different investment options before making any decisions. Consider your time horizon, risk tolerance, and financial objectives when building your Roth IRA portfolio. Consulting with a qualified financial advisor can help you develop a personalized investment strategy that aligns with your goals.

How Withdrawals Work

Withdrawals are the process of removing funds from an account. The specific process for withdrawing money depends on the type of account you have. For example, withdrawing from a checking account can be done via ATM, debit card purchase, check, or in person at a bank branch. Withdrawal methods and available funds are key factors impacting the speed and ease of withdrawing money.

Certain accounts may have restrictions on withdrawals. Retirement accounts, like 401(k)s or IRAs, often have penalties for early withdrawals. Penalties can include taxes and fees, so understanding the terms and conditions of your account is crucial. Some accounts may also have withdrawal limits, restricting the amount of money you can withdraw within a certain timeframe.

Before initiating a withdrawal, it’s important to verify your account balance to avoid overdraft fees or declined transactions. Be mindful of any processing times, which can vary depending on the method and institution. For large withdrawals, you may need to notify your financial institution in advance. Always keep your account information secure and be aware of potential scams.

Roth IRA for Young Investors

A Roth IRA is a powerful tool for young investors. Contributions are made with after-tax dollars, meaning you won’t get a tax deduction now. However, the real advantage comes later. Your investments grow tax-free, and when you withdraw in retirement, both your contributions and earnings are completely tax-free. This is especially beneficial for young people as they are likely in a lower tax bracket now than they will be in retirement.

Starting early is crucial. The power of compounding allows even small contributions to grow significantly over time. The longer your money is invested, the more it can grow exponentially. Even if you can only contribute a small amount each month, the earlier you start, the better off you’ll be. Time is your greatest asset as a young investor.

While retirement may seem far off, a Roth IRA offers more than just retirement savings. In certain circumstances, you can withdraw your contributions (but not the earnings) penalty-free and tax-free for qualified expenses such as a down payment on a first home or education expenses. This flexibility makes a Roth IRA an attractive option for young adults who are also planning for other major life events.

Using Roth IRA for Estate Planning

A Roth IRA can be a powerful tool in estate planning, offering tax advantages for both you and your beneficiaries. Unlike traditional IRAs, contributions are made with after-tax dollars, meaning qualified withdrawals in retirement are tax-free. This tax-free growth and distribution can be a significant benefit for heirs, especially if they are in a higher tax bracket than you were.

Another key advantage of Roth IRAs for estate planning is their flexibility. There are no required minimum distributions (RMDs) during the owner’s lifetime, allowing you to maintain control of your assets and continue to benefit from tax-free growth. Upon your death, beneficiaries can stretch out distributions over their lifespan, minimizing their tax burden and maximizing the long-term growth potential of the inherited IRA.

When incorporating a Roth IRA into your estate plan, it’s crucial to name your beneficiaries correctly and keep them updated. Proper beneficiary designations avoid probate and ensure a smooth transfer of assets. You can also name a trust as beneficiary, providing more control over how and when the funds are distributed, especially if you have minor children or beneficiaries with special needs.