Comparing mortgage rates is a crucial step in the home-buying process. Securing the lowest possible interest rate can save you thousands of dollars over the life of your loan. This guide will provide you with practical strategies to effectively compare mortgage rates, empowering you to make informed decisions and secure the best possible deal for your financial future. Understanding key factors like APR, loan terms, and lender fees is essential to making a sound comparison and maximizing your savings.

Navigating the complexities of mortgage rates can be challenging. From fixed-rate mortgages to adjustable-rate mortgages (ARMs), understanding the nuances of each option is critical. This article will equip you with the knowledge and tools to compare mortgage rates from various lenders, decipher industry jargon, and ultimately choose the mortgage that best aligns with your financial goals and individual circumstances. We’ll delve into the importance of credit scores, loan types, and closing costs, giving you a comprehensive understanding of the mortgage landscape.

Why Mortgage Rate Comparison Matters

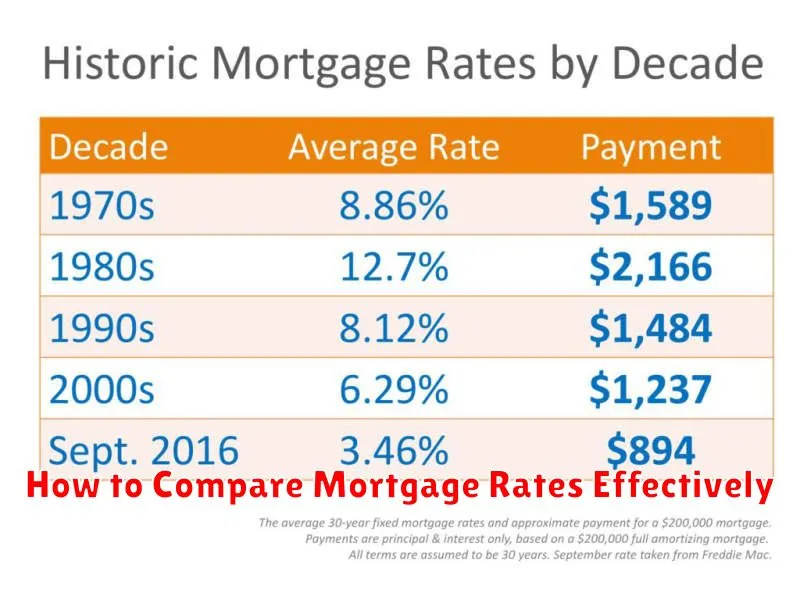

Comparing mortgage rates is a crucial step in the home-buying process. Different lenders offer varying rates and terms, which can significantly impact the overall cost of your loan. A seemingly small difference in interest rates can translate into thousands of dollars paid over the life of the mortgage. By diligently comparing offers, borrowers can secure the most favorable terms and potentially save substantial amounts of money.

Shopping around for the best mortgage rate allows you to evaluate various loan options and choose the one that best aligns with your financial situation. Factors such as loan type (fixed-rate, adjustable-rate, FHA, VA), loan term (15-year, 30-year), and closing costs all play a role in determining the total cost. Comparing these factors across multiple lenders empowers borrowers to make informed decisions and choose the loan product that best meets their individual needs and budget.

Taking the time to compare mortgage rates helps ensure you aren’t overpaying for your home loan. It allows you to negotiate from a position of strength, potentially securing a lower rate or better terms from a lender. This proactive approach can significantly impact your long-term financial health by reducing your monthly payments and the total interest paid over the life of the loan.

Types of Mortgage Rates Explained

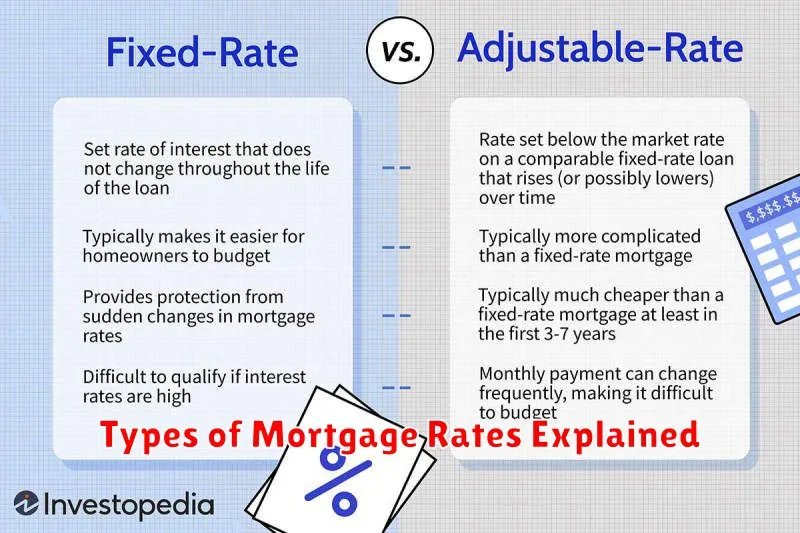

Choosing the right mortgage is a crucial step in homeownership. Understanding the different types of mortgage rates available can significantly impact your financial future. The most common types include fixed-rate mortgages, where the interest rate remains constant throughout the loan term, offering predictable monthly payments. Alternatively, adjustable-rate mortgages (ARMs) offer an initial fixed-rate period followed by a fluctuating rate based on market indices. ARMs can be attractive with lower initial rates, but carry the risk of rising rates and payments later on. Finally, there are several government-backed loan programs, such as FHA, VA, and USDA loans, each with specific eligibility requirements and potential benefits.

Within these categories, various loan terms are available, typically ranging from 15 to 30 years. A shorter loan term results in higher monthly payments but lower overall interest paid, while a longer loan term means lower monthly payments but higher overall interest. Your credit score, down payment amount, and debt-to-income ratio are key factors influencing the interest rate you’ll qualify for. A higher credit score and larger down payment generally lead to lower interest rates.

It’s essential to carefully consider your financial situation, risk tolerance, and long-term goals when choosing a mortgage rate. Consulting with a mortgage professional can provide personalized guidance and help you navigate the complexities of selecting the best option for your circumstances.

APR vs. Interest Rate

While often used interchangeably, APR (Annual Percentage Rate) and interest rate are not the same. The interest rate is the basic cost of borrowing money, expressed as a percentage. It reflects the amount you’ll pay annually for the privilege of using the lender’s funds. Think of it as the base price.

APR, on the other hand, provides a more comprehensive view of the borrowing cost. It includes the interest rate but also incorporates other fees associated with the loan, such as origination fees, closing costs, and mortgage insurance. This provides a more accurate representation of the true annual cost of the loan, making it easier to compare different loan offers.

Therefore, when considering a loan, focus on the APR as it reflects the total cost. While the interest rate is important, the APR gives a clearer picture of what you’ll actually pay. A lower APR is generally the better deal, even if the interest rate is slightly higher, provided the loan terms are comparable.

Tools to Compare Rates Online

Comparing rates for financial products like loans, insurance, or credit cards can be a time-consuming process. Fortunately, numerous online tools simplify this task. These tools, often referred to as comparison websites or aggregators, collect information from multiple providers and present it in a user-friendly format. This allows consumers to quickly evaluate key factors such as interest rates, fees, and terms, empowering them to make informed decisions.

Using these tools is generally straightforward. Users typically input specific criteria, such as the desired loan amount, the type of insurance coverage needed, or their credit score. The tool then generates a list of options from different providers, often ranked by cost or other relevant metrics. Some platforms offer advanced filtering features, allowing users to refine their search based on specific needs and preferences. It’s crucial to remember that these tools may not encompass every available provider, so conducting independent research is still advisable.

While online comparison tools offer significant convenience and efficiency, it’s essential to use them responsibly. Be aware that some platforms may prioritize offers from providers that pay advertising fees. Carefully review all terms and conditions before committing to any product. These tools are valuable resources for preliminary research and comparing rates, but they shouldn’t replace thorough due diligence.

How Credit Score Affects Rates

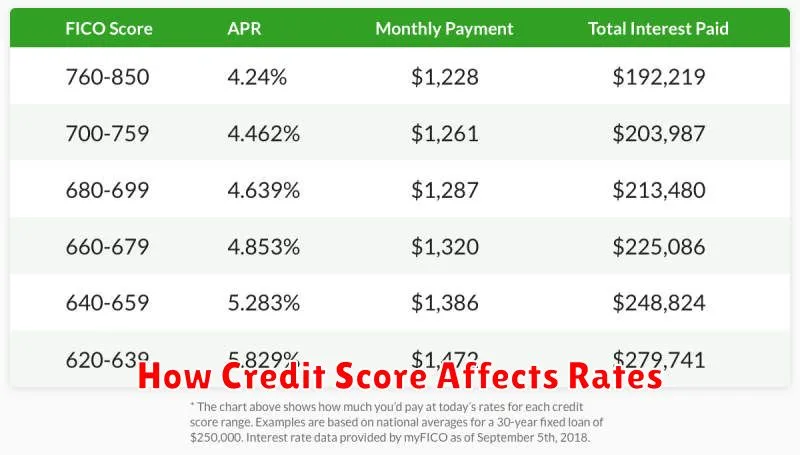

Your credit score plays a crucial role in determining the interest rates you receive on loans and credit cards. Lenders use your score as an indicator of your creditworthiness, or how likely you are to repay borrowed money. A higher credit score suggests a lower risk to the lender, leading to lower interest rates and better loan terms. Conversely, a lower credit score indicates a higher risk, resulting in higher interest rates and potentially less favorable loan terms. This is because lenders want to compensate for the increased risk of default.

The impact of your credit score on interest rates can be significant. Even a small difference in your score can translate to thousands of dollars in interest paid over the life of a loan, especially for large purchases like a mortgage or auto loan. For example, someone with excellent credit might qualify for a mortgage rate several percentage points lower than someone with fair credit. This seemingly small difference can equate to substantial savings over time.

By understanding the relationship between credit scores and interest rates, you can take steps to improve your score and secure better financing options. Paying bills on time, keeping credit utilization low, and regularly checking your credit report for errors are effective ways to manage your credit and potentially lower your borrowing costs.

Government-Backed Loan Options

Government-backed loans offer borrowers a lower risk option compared to conventional loans. These loans are partially insured or guaranteed by a government agency, which incentivizes lenders to offer more favorable terms, such as lower interest rates and down payments. Several types of government-backed loans exist, each serving a specific purpose. The most common include FHA loans (Federal Housing Administration), ideal for first-time homebuyers with lower credit scores; VA loans (Veterans Affairs), designed for eligible veterans, service members, and surviving spouses; and USDA loans (US Department of Agriculture), which support rural development and homeownership in designated areas.

Understanding the eligibility requirements is crucial when considering a government-backed loan. FHA loans typically require a minimum credit score of 500, while VA loans have more flexible credit requirements. USDA loans also have income limits to ensure they benefit those most in need. Additionally, each loan type has specific loan limits that vary by location. It’s essential to research these factors carefully to determine which loan best suits your individual circumstances.

While government-backed loans provide significant advantages, borrowers should also be aware of the associated costs and fees. These may include upfront mortgage insurance premiums, annual premiums, and guarantee fees. Though these costs can increase the overall borrowing expense, they are often offset by the lower interest rates and down payment requirements. Consulting with a qualified lender is essential to navigate the application process, understand the terms and conditions, and make an informed decision about the best government-backed loan option.

When to Lock Your Rate

Locking your interest rate guarantees a specific rate for a set period, typically 30 to 60 days, while you finalize your mortgage. This protects you from potential rate increases during that time. It’s especially beneficial in a rising rate environment. However, if rates fall, you could miss out on a lower rate. Carefully consider your personal risk tolerance and market conditions.

Consider locking your rate when you’re confident in your loan application and have chosen a lender. This often happens after receiving a pre-approval and finding a home you intend to purchase. Early locks can provide peace of mind but may have fees associated. Waiting too long carries the risk of rates rising before closing.

Discuss lock options with your lender, including the lock period, float-down provisions (allowing you to benefit from rate drops), and any associated fees. Understanding these details will help you make an informed decision based on your individual circumstances and market trends.

Questions to Ask Your Lender

Choosing the right lender is a crucial step in securing a loan. Before committing, ask about interest rates, both fixed and variable, and how they are calculated. Inquire about all fees associated with the loan, including origination fees, appraisal fees, and prepayment penalties. Understanding the total cost of the loan is essential. Don’t hesitate to ask about different loan terms and how they impact your monthly payments and the overall cost of borrowing. Finally, inquire about the lender’s requirements for approval, such as credit score minimums and debt-to-income ratios.

Beyond the basics, it’s important to understand the lender’s communication practices. Ask how they will keep you informed throughout the loan process. Inquire about their customer service availability and how to reach someone if you have questions or concerns. Consider asking about their online platform and if you can manage your loan online. Researching the lender’s reputation and reading online reviews can provide valuable insights into their service and reliability.

Lastly, compare offers from multiple lenders to ensure you are getting the best possible terms. Don’t feel pressured to commit to the first lender you speak with. Take the time to carefully evaluate each offer and choose the lender that best meets your individual needs. This comparison shopping can save you significant money over the life of your loan.

Refinancing and Rate Adjustments

Refinancing involves replacing an existing loan with a new one, often to secure a lower interest rate, change loan terms, or access cash. Carefully consider the closing costs associated with refinancing, as these expenses can offset the benefits of a lower rate if you don’t plan to stay in the loan long enough. Refinancing can be a powerful tool to reduce your monthly payments, shorten your loan term, or switch from an adjustable-rate mortgage to a fixed-rate mortgage.

Rate adjustments typically apply to adjustable-rate mortgages (ARMs). These loans offer an initial fixed interest rate period, after which the rate fluctuates based on a specific index, like the prime rate. Understanding the frequency of adjustments, the caps on rate increases, and the lifetime cap are crucial when considering an ARM. While ARMs may offer lower initial rates, it’s important to assess your tolerance for potential rate increases in the future.

Both refinancing and rate adjustments impact your monthly mortgage payments and the total cost of your loan. Before making a decision, compare offers from multiple lenders, thoroughly review the loan terms, and use a mortgage calculator to estimate the long-term financial implications. Consulting with a financial advisor can provide further guidance.