Planning for retirement is a continuous process, and your 40s represent a crucial period for solidifying your financial future. While retirement may seem distant, the choices you make in this decade can significantly impact your comfort and security later in life. Avoiding common retirement planning mistakes in your 40s is paramount to achieving your retirement goals. This article will explore some of the most detrimental errors to avoid, helping you navigate this important phase and build a strong foundation for a secure and enjoyable retirement.

Many individuals in their 40s find themselves juggling multiple financial responsibilities, from raising families and paying off mortgages to managing career transitions. These competing priorities can sometimes overshadow the importance of retirement planning. However, neglecting retirement savings during this decade can lead to significant challenges down the road. By understanding and avoiding common pitfalls, you can maximize your retirement savings potential and ensure a smoother transition into your golden years. From underestimating future expenses to neglecting to adjust your investment strategy, we’ll cover the key mistakes to avoid and provide actionable guidance for successful retirement planning in your 40s.

Why Your 40s Are Crucial for Retirement

Your 40s represent a pivotal period for retirement planning. While retirement may seem distant, this decade offers a critical opportunity to assess your current financial standing and make necessary adjustments to ensure a comfortable future. The power of compounding interest becomes increasingly significant as you approach retirement. The contributions you make and the investment growth you experience in your 40s will have a substantial impact on your final retirement nest egg. This is also the time to seriously evaluate your retirement goals, considering factors such as desired lifestyle, healthcare expenses, and potential long-term care needs.

Taking proactive steps in your 40s can significantly enhance your retirement prospects. Firstly, maximize contributions to retirement accounts. If you haven’t already, aim to contribute the maximum allowed to employer-sponsored plans like 401(k)s and consider opening or contributing more to Individual Retirement Accounts (IRAs). Secondly, manage debt strategically. Prioritize paying down high-interest debt, such as credit card balances, to free up more funds for retirement savings. Thirdly, review your investment portfolio. Ensure your asset allocation aligns with your risk tolerance and time horizon, potentially adjusting to a slightly more conservative approach as retirement nears.

While focusing on accumulating savings is paramount, don’t neglect other crucial aspects of retirement planning. Evaluate your insurance coverage, including life insurance and disability insurance, to protect your family and income stream. Create or update your estate plan, including a will or trust, to ensure your assets are distributed according to your wishes. Finally, start to visualize your retirement lifestyle and research potential living arrangements and activities. By taking these proactive steps in your 40s, you can lay a solid foundation for a secure and fulfilling retirement.

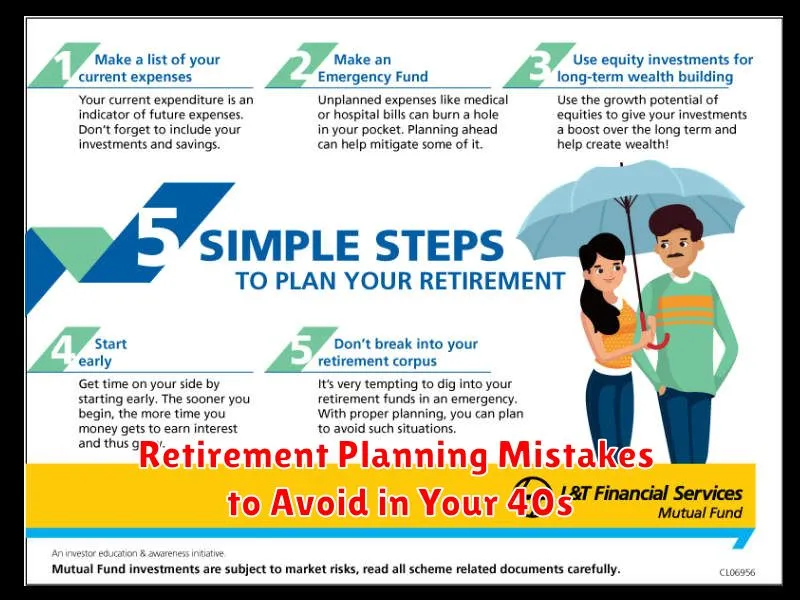

Not Having a Retirement Plan

Not having a retirement plan is a critical financial oversight. It means foregoing the opportunity to accumulate savings specifically designated for supporting oneself after leaving the workforce. This can lead to financial insecurity during retirement, relying solely on Social Security or limited personal savings which might prove inadequate to cover living expenses and healthcare costs.

Developing a retirement plan is essential for securing your financial future. It involves determining your anticipated expenses, setting realistic savings goals, and choosing appropriate investment vehicles to grow your savings over time. There are several options available, including employer-sponsored 401(k) plans, Individual Retirement Accounts (IRAs), and annuities. Contributing regularly, even small amounts, and taking advantage of employer matching contributions, where applicable, can significantly impact your retirement nest egg.

Without a plan, individuals risk facing a lower quality of life in retirement, potentially delaying retirement altogether, or having to rely on family for financial support. Start planning early. The power of compounding interest means that starting even a small amount now will have a more significant impact than larger contributions made later.

Delaying Contributions Too Long

Delaying contributions to retirement savings can significantly impact long-term financial security. Time is a critical factor in compounding returns. The earlier you start, the more time your investments have to grow, allowing even small contributions to accumulate substantial value over time. Conversely, postponing saving requires significantly larger contributions later to achieve the same outcome, potentially straining budgets and increasing financial stress in later years.

Compounding is the key to wealth accumulation. Each year’s returns generate earnings, and those earnings then generate their own returns. This exponential growth is amplified over longer periods. A younger investor benefits from decades of compounding, while an older investor who starts later misses out on this crucial early growth phase. Therefore, delaying contributions significantly reduces the potential for long-term growth and ultimately lowers the final value of retirement savings.

Beyond compounding, starting early offers other advantages. It fosters good financial habits and establishes a strong foundation for long-term financial well-being. Early contributions allow for greater flexibility in handling unforeseen financial challenges and create a cushion for economic uncertainty. Beginning early provides a wider window of opportunity to adjust investment strategies and recover from market downturns.

Ignoring Employer Match Opportunities

Failing to take advantage of an employer match on retirement contributions is a costly oversight. This essentially means turning down free money. Employer matching is a powerful tool for building wealth, where your employer contributes a certain percentage or amount to your retirement savings plan based on your own contributions. By not participating, you’re missing out on potential gains and significantly limiting your retirement nest egg’s growth.

The impact of forgoing the employer match can be substantial over the long term. Consider this: if your employer offers a 50% match on contributions up to 6% of your salary, and you earn $50,000 annually, you’re leaving $1,500 on the table each year. Over a 30-year career, assuming an average annual return of 7%, this missed opportunity could cost you over $130,000 in potential earnings. This illustrates the importance of maximizing your contributions to at least receive the full employer match.

Start contributing to your retirement plan today, even if it’s a small amount initially. Gradually increase your contribution rate whenever possible, aiming to at least capture the full employer match. Speak with your HR or benefits department to understand your company’s specific matching policy and deadlines. This seemingly small step can have a profound impact on your financial future.

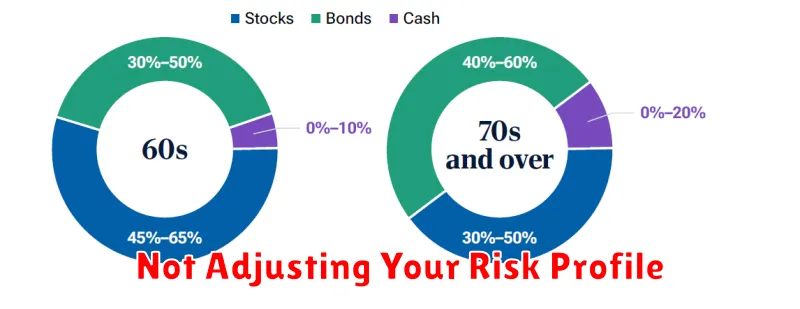

Not Adjusting Your Risk Profile

A common investment mistake is failing to periodically review and adjust your risk profile. Life changes such as marriage, having children, changing jobs, or approaching retirement significantly impact your financial goals and risk tolerance. A portfolio appropriate for a single person in their 20s might be far too aggressive for someone nearing retirement. Ignoring these shifts can lead to unnecessary stress and potentially jeopardize your financial future.

Understanding your risk tolerance is crucial. This involves honestly assessing your comfort level with potential investment losses. Are you willing to accept higher volatility for the potential of higher returns, or do you prioritize preserving capital even if it means more modest growth? Your risk profile should also consider your time horizon – the length of time you have until you need the money. Longer time horizons generally allow for greater risk-taking.

Regularly reviewing your risk profile, ideally annually or after significant life events, ensures your investments remain aligned with your goals and comfort level. This may involve rebalancing your portfolio, shifting towards more conservative or aggressive investments as needed. Neglecting this crucial step can expose you to unnecessary risk and potentially hinder your progress towards achieving your financial objectives.

Failing to Estimate Retirement Needs

One of the most common mistakes in retirement planning is failing to accurately estimate retirement needs. Many people underestimate how much money they’ll actually need to maintain their lifestyle after they stop working. This can stem from not fully considering factors like inflation, increased healthcare costs, potential long-term care expenses, and the desired level of travel or leisure activities. Accurately projecting these expenses is crucial to building a sufficient retirement nest egg.

Another aspect of this oversight involves not accounting for longevity. People are living longer, meaning retirement can last for several decades. Underestimating lifespan can lead to depleting savings prematurely. It’s important to factor in a realistic lifespan based on family history, current health, and overall life expectancy projections when determining how much money will be required throughout retirement. Additionally, relying solely on general rules of thumb, rather than conducting a personalized assessment, can further contribute to miscalculating necessary funds.

Failing to estimate retirement needs can have serious consequences, ranging from having to significantly reduce spending in retirement to running out of money altogether. Working with a financial advisor can be beneficial in developing a comprehensive retirement plan that accurately accounts for individual circumstances and goals. Taking the time to carefully evaluate and project retirement needs is a vital step towards ensuring a secure and comfortable future.

Over-Relying on Social Security

While Social Security provides a crucial safety net for retirement, over-reliance on it can be problematic. It is designed to be a supplement to personal savings, not the sole source of income. Depending entirely on Social Security benefits can lead to a lower standard of living in retirement, especially considering the rising cost of living and potential future adjustments to the system.

It’s important to remember that Social Security benefits are calculated based on your earnings history. Higher earners receive larger benefits, but even these may not be enough to maintain a pre-retirement lifestyle. Diversifying your retirement savings through 401(k)s, IRAs, and other investments is essential to ensure a comfortable retirement.

Building a robust retirement plan requires a proactive approach. Start saving early, explore different investment options, and consult with a financial advisor to create a personalized strategy. This will help lessen your dependence on Social Security and provide greater financial security in your later years.

Neglecting Health-Related Savings

Many individuals underestimate the importance of health-related savings. Failing to plan for unexpected medical expenses can lead to significant financial hardship. This can include high medical bills, lost wages due to illness, and the costs associated with long-term care. Ignoring the potential for these costs can leave individuals vulnerable and unprepared when health crises arise.

Building a health savings fund can provide a critical safety net. This fund can be used to cover deductibles, co-pays, and other out-of-pocket expenses not covered by insurance. It can also help bridge the gap in income should an illness prevent you from working. Proactive saving can significantly reduce financial stress during challenging times.

There are several ways to establish health-related savings. Consider setting up a dedicated savings account specifically for medical expenses. Explore options like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) if eligible. Even small, regular contributions can make a substantial difference over time in building a financial cushion for future healthcare needs.

How to Catch Up Efficiently

Falling behind can feel overwhelming, but catching up efficiently is achievable with the right approach. Start by prioritizing. Identify the most urgent and important tasks. Focus on those first to make the biggest impact. Break down larger tasks into smaller, more manageable steps. This will make the overall process seem less daunting and allow you to track your progress more easily.

Time management is crucial. Establish a realistic schedule that allocates specific time blocks for catching up. Minimize distractions during these periods by turning off notifications and creating a focused work environment. Utilize productivity techniques like the Pomodoro method to maintain focus and prevent burnout. Remember to incorporate short breaks to refresh and recharge.

Finally, seek support if needed. Don’t hesitate to ask for help from colleagues, friends, or family. Delegating certain tasks, if possible, can also alleviate some of the burden. Most importantly, maintain a positive mindset. Focus on your progress and celebrate small victories along the way. Catching up takes time and effort, so be patient with yourself and stay persistent.