Finding the best high-interest checking accounts is crucial for maximizing your earnings in 2025. With interest rates fluctuating, it’s more important than ever to ensure your money is working as hard as it can for you. This article explores the top high-yield checking accounts available, helping you make an informed decision and unlock the highest possible return on your deposits. We’ll delve into the key features, including interest rates, fees, minimum balance requirements, and ATM access, to identify the accounts that truly stand out in the competitive landscape of 2025.

Whether you’re looking to park a substantial sum or simply want to earn more on your everyday funds, a high-interest checking account can be a valuable tool. By comparing the best checking accounts of 2025, you can pinpoint the ideal account that aligns with your financial goals. From online banks offering competitive rates to traditional institutions with robust features, we’ll cover a range of options to help you navigate the search for the highest-earning checking account that suits your needs.

What Is a High-Interest Checking Account?

A high-interest checking account is a type of deposit account that offers a higher-than-average annual percentage yield (APY) on your balance. Unlike traditional checking accounts, which often offer minimal interest, high-interest checking accounts aim to help your money grow while still providing the convenient features of a regular checking account, such as debit card access, check writing, and online bill pay.

While attractive, these accounts often come with certain requirements to earn the higher APY. These may include maintaining a minimum balance, setting up direct deposit, or making a specific number of debit card transactions each month. It’s crucial to understand these requirements before opening an account to ensure you can meet them and maximize your earnings.

By offering competitive interest rates, high-interest checking accounts provide an opportunity to earn more on your everyday funds. However, it’s essential to compare different accounts and consider the associated fees and requirements before choosing the best one for your financial needs. Don’t hesitate to contact the financial institutions directly to clarify any details and make an informed decision.

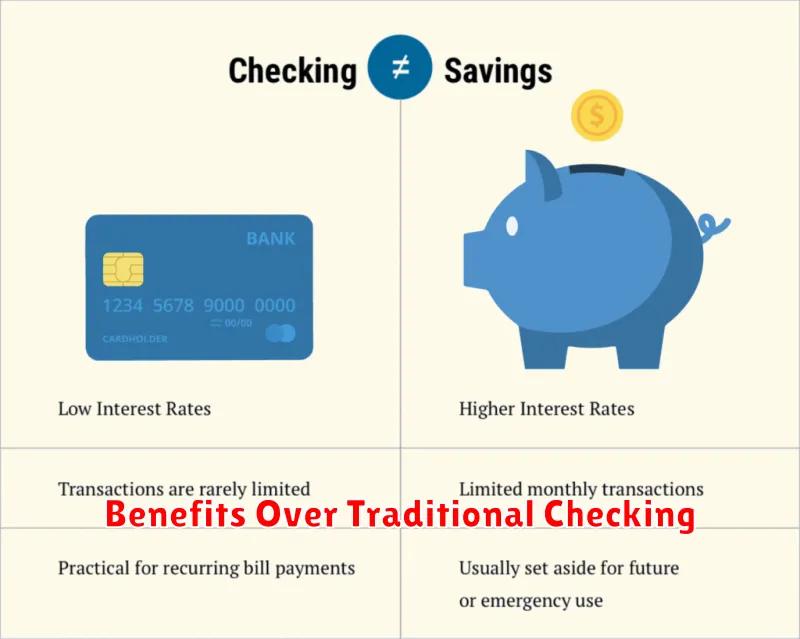

Benefits Over Traditional Checking

Online checking accounts offer several key advantages over their traditional counterparts. One primary benefit is lower fees. Traditional banks often have monthly maintenance fees, minimum balance requirements, and paper statement fees, which can quickly add up. Online checking accounts frequently waive these fees, saving customers money. Accessibility is another advantage, with account access available 24/7 through online platforms and mobile apps. This eliminates the need for in-person bank visits and provides greater control over finances.

Higher interest rates are another compelling reason to choose online checking. Since online banks have lower overhead costs, they can often offer higher interest rates on checking account balances than traditional banks. While these rates may still be lower than those found in savings accounts, they allow customers to earn some return on their deposited funds, helping their money grow. Additionally, some online banks offer rewards programs tied to their checking accounts, providing cashback or other perks for everyday spending.

While online checking offers significant benefits, it’s important to consider some potential drawbacks. Depositing cash can be more complicated without physical branch access, often requiring mail-in deposits or transfers from another account. While customer service is generally available online and by phone, some individuals may prefer the in-person interaction offered at traditional banks. Finally, it is crucial to choose a reputable and FDIC-insured online bank to ensure the safety of your funds.

Top Banks Offering High Rates

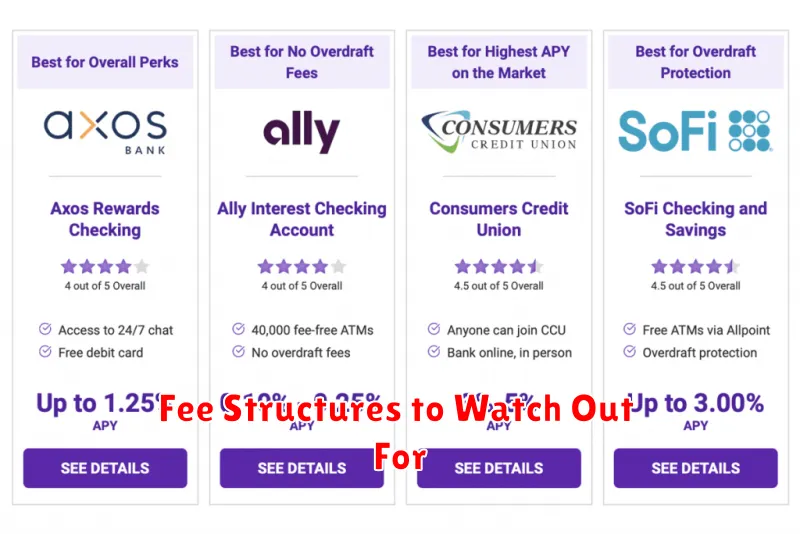

Several banks are currently offering highly competitive interest rates on various deposit accounts. These high-yield options can provide a significant advantage for consumers looking to maximize their returns on savings. It is crucial to compare rates and terms from different institutions before making a decision, as offers can vary significantly. Factors to consider include the minimum deposit requirement, the account type (such as savings accounts, money market accounts, or certificates of deposit), and any associated fees.

Finding the right high-yield account requires diligent research. Look for banks with a strong reputation and FDIC insurance. Consider your individual financial goals and choose an account that aligns with your needs. For example, if you need frequent access to your funds, a high-yield savings account may be preferable to a certificate of deposit, which typically locks in your money for a specified term. Be sure to review the terms and conditions carefully before opening an account.

Consumers can often find competitive rates from both national banks and online banks. While national banks offer the convenience of physical branches, online banks sometimes offer higher rates due to lower overhead costs. Ultimately, the best bank for you will depend on your specific requirements and preferences.

Eligibility and Monthly Requirements

To be eligible for this program, individuals must meet specific criteria. Applicants must be legal residents of the designated service area. Additionally, they must demonstrate financial need falling within the established income guidelines. Proof of residency and income will be required during the application process. Further eligibility requirements may apply depending on the specific program and will be outlined in the application materials.

Participants are expected to fulfill certain monthly requirements to maintain their eligibility. These requirements often include regular reporting of income and expenses. Attendance at mandatory meetings or workshops may also be required. Failure to comply with these monthly obligations may result in suspension or termination from the program.

Specific details regarding the program’s eligibility criteria and monthly requirements can be obtained by contacting the program administrator directly. It is crucial for potential applicants to thoroughly review all requirements before applying to ensure they understand and can fulfill the program’s obligations.

Fee Structures to Watch Out For

When choosing financial products or services, it’s crucial to understand the fee structure. Hidden fees can significantly impact your returns or overall cost. Pay close attention to expense ratios for investments, transaction fees for bank accounts, and annual fees for credit cards. Don’t be afraid to ask questions and compare options to find the most cost-effective solutions.

Some common fee structures include flat fees, which are fixed charges for a particular service, and percentage-based fees, calculated as a portion of your assets or transaction amount. Tiered fees change based on the amount of assets managed or the volume of transactions. Understanding these different structures helps you accurately assess the true cost.

Be wary of load fees on mutual funds, which are charged when you buy or sell shares. Also, watch out for early withdrawal penalties on certain investments like CDs or annuities. Inactivity fees can be charged if you don’t use your account regularly. By being aware of these potential charges, you can make informed decisions and avoid unnecessary expenses.

How to Open an Account Online

Opening an account online is typically a quick and easy process. First, you’ll need to choose the type of account you want, such as a checking, savings, or money market account. Then, select the institution where you want to open the account. Research different banks and credit unions to compare fees, interest rates, and available services. Once you’ve made your selection, navigate to the institution’s website and locate the “Open an Account” button or link.

Next, you’ll need to complete the application. This usually involves providing your personal information, such as your name, address, date of birth, and social security number. You may also need to provide identification, like a driver’s license or passport. Be prepared to answer security questions and agree to the institution’s terms and conditions. Some institutions may also require a minimum deposit to open the account, so have your funding source ready.

Finally, review and submit your application. Carefully check all the information you’ve entered for accuracy before submitting. Once your application is approved, you’ll receive confirmation and instructions on how to access your new account online and begin using its features.

Tips for Maximizing Interest

Earning more interest on your savings requires a strategic approach. One key factor is choosing the right account type. High-yield savings accounts and certificates of deposit (CDs) generally offer better interest rates than traditional savings accounts. Comparing rates across different financial institutions is crucial to finding the most competitive offers. Keep in mind that CDs typically require you to lock in your money for a specific period, while high-yield savings accounts offer more flexibility.

Another important factor is the frequency of compounding. The more frequently interest is compounded (e.g., daily or monthly), the faster your balance grows. This is because you earn interest not only on your initial principal but also on the accumulated interest. Understanding the compounding frequency can help you project your potential earnings more accurately.

Finally, consider additional strategies to boost your returns. For example, some banks offer rate bumps for maintaining a certain minimum balance or setting up automatic deposits. Explore these options to potentially increase your interest earnings further.

How Interest Is Calculated

Interest is calculated based on the principal amount, the interest rate, and the time period the money is borrowed or invested. The simplest form, simple interest, is calculated by multiplying these three factors together. For example, if you borrow $1,000 at a 5% annual interest rate for one year, the simple interest would be $1,000 * 0.05 * 1 = $50.

Compound interest, on the other hand, is calculated on the principal plus any accumulated interest. Essentially, you earn interest on your interest. This leads to exponential growth over time. The frequency of compounding (e.g., daily, monthly, annually) affects how quickly the interest accrues. The more frequent the compounding, the faster the growth.

Lenders and financial institutions use various formulas to calculate interest depending on the specific type of loan or investment product. These calculations can become more complex when factoring in things like varying interest rates, fees, and different compounding periods. Understanding how interest is calculated is crucial for making informed financial decisions.